Credit score ratings are categorized into four ranges: bad, fair, good, and excellent. It is essential to know where your credit score falls within these ranges in order to make informed financial decisions.

Understanding your credit rating can help you determine your eligibility for loans, credit cards, and other financial services. By monitoring and improving your credit score, you can work towards achieving a higher rating and enjoying the benefits that come with it.

With that in mind, let’s explore the different credit score ratings in more detail and how they can impact your financial well-being.

Introduction To Credit Score Ratings

Learn about Credit Score Ratings and their importance in evaluating your financial health. Discover the different ranges of credit scores, from bad to excellent, and understand how they impact your ability to secure loans and favorable interest rates.

What Is A Credit Score?

A credit score is a three-digit number that represents your financial reliability and creditworthiness. It is a numerical expression of your credit history and is used by lenders, landlords, and creditors to assess your creditworthiness before granting you a loan, credit card, or other financial opportunities.

Why Is Your Credit Score Important?

Having a good credit score is essential for various financial aspects of your life. It plays a significant role when applying for loans, mortgages, credit cards, or even renting an apartment. Lenders use your credit score to determine your risk level and decide whether to approve your application or not.

A good credit score indicates that you have a solid credit history, which means you have been responsible with credit and have a history of timely payments. This increases your chances of getting approved for loans, credit cards with better interest rates, and favorable terms and conditions. On the other hand, a bad credit score can result in higher interest rates or even denial of credit.

Understanding Credit Score Ratings

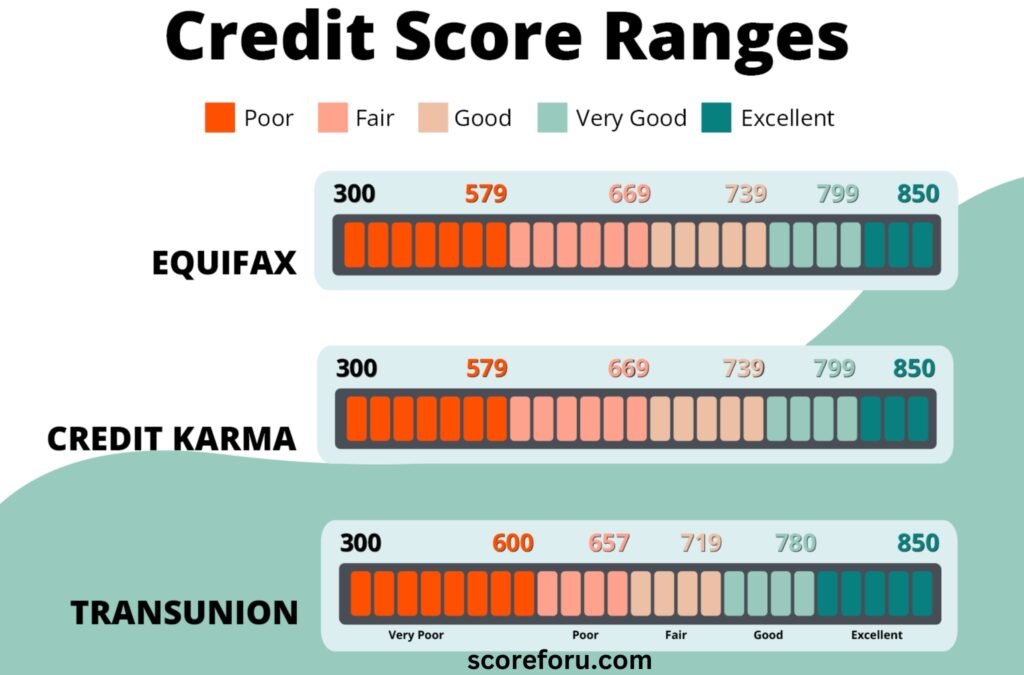

Credit score ratings are divided into different ranges, which help lenders evaluate your creditworthiness quickly. The most commonly used credit score range is the FICO score range, which is widely recognized in the industry.

Here are the different credit score ranges according to FICO:

| Credit Score Range | Credit Score Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Exceptional |

It’s important to note that each lender may have their own interpretation of the credit score ranges, but generally, a higher score indicates lower credit risk and vice versa.

Now that you have a basic understanding of credit score ratings, you can take steps to improve your credit score and maintain a healthy financial profile. In the next section, we will explore how to improve your credit score and why it is vital for your financial future.

Factors Affecting Your Credit Score

Your credit score is a crucial number that lenders use to determine your creditworthiness. It indicates your ability to manage and repay debts. Several factors play a significant role in determining your credit score, and understanding these factors is essential for maintaining a healthy credit profile.

Payment History

Your payment history carries the most weight in determining your credit score. It reflects how consistently you make on-time payments towards your debts. Any late payments, defaults, or collection accounts can negatively impact your credit score. On the other hand, a history of timely payments can greatly improve your creditworthiness.

Amounts Owed

The amount you owe accounts for a significant portion of your credit score. It considers your credit utilization ratio, which is the percentage of available credit you are currently using. Keeping your credit card balances low and avoiding maxing out your credit limits can help improve your credit score.

Length Of Credit History

The length of your credit history is another crucial factor that affects your credit score. It considers the average age of your accounts, including the oldest and newest accounts. A longer credit history indicates a more stable financial behavior, which can positively impact your credit score.

Types Of Credit

The types of credit you have also influence your credit score. It considers a combination of credit cards, loans, and mortgages. Having a diverse mix of credit accounts and demonstrating responsible management of different types of credit can enhance your creditworthiness.

New Credit Applications

Applying for new credit can impact your credit score. Each credit application results in a hard inquiry on your credit report, which can slightly lower your score. Additionally, opening multiple new accounts within a short period can indicate higher risk to lenders. It’s important to be mindful of how frequently you apply for new credit.

Improving Your Credit Score

Improving your credit score is an important step towards financial stability and achieving your goals. A good credit score not only helps you secure loans and credit cards, but it also demonstrates your financial responsibility to prospective landlords, employers, and insurance companies. In this section, we will explore five key strategies for improving your credit score: paying bills on time, reducing debt, building a long credit history, diversifying credit types, and being cautious with new credit applications.

Paying Bills On Time

One of the most impactful actions you can take to improve your credit score is paying your bills on time. Late payments can have a detrimental effect on your credit score, as they indicate a lack of financial responsibility. To ensure that you never miss a payment deadline, consider setting up automatic payments or reminders on your smartphone. Additionally, it’s important to prioritize high-interest debts, such as credit card balances, to minimize the overall impact on your credit score.

Reducing Debt

Another effective strategy for improving your credit score is reducing your overall debt. High levels of debt can negatively impact your credit utilization ratio, which measures the percentage of available credit you are currently using. Aim to keep your credit utilization below 30% to demonstrate your ability to manage your debts responsibly. To reduce your debt, consider creating a budget, increasing your income, and exploring debt consolidation options to streamline your payments.

Building A Long Credit History

Having a long credit history can positively impact your credit score. Lenders and creditors prefer borrowers with a proven track record of responsible credit use. To build a long credit history, start by opening a credit account, such as a credit card or a small loan. Make regular payments and avoid maxing out your available credit. It’s important to be patient, as it takes time for your credit history to reflect your responsible behavior.

Diversifying Credit Types

Having a mix of different types of credit accounts can also improve your credit score. Lenders like to see that you can manage different forms of credit, such as credit cards, installment loans, and mortgages. When diversifying your credit, be mindful of your ability to manage the various accounts effectively. Only take on what you can handle and avoid taking on unnecessary debt for the sake of diversification.

Being Cautious With New Credit Applications

Lastly, it’s important to be cautious with new credit applications. Applying for multiple lines of credit within a short period can negatively impact your credit score. Each application generates a hard inquiry on your credit report, signaling to lenders that you might be taking on too much debt or struggling financially. Before applying for new credit, evaluate whether it’s necessary and consider the potential impact on your credit score.

FAQ On Credit Score Ratings

What Are The 5 Levels Of Credit Scores?

The five levels of credit scores are bad, fair, good, and excellent. These categories help determine your creditworthiness and can impact your ability to borrow money or get favorable interest rates. Your credit score is based on factors like payment history, amounts owed, new credit, length of credit history, and credit mix.

What Are The 4 Levels Of Credit Ratings?

The four levels of credit ratings are bad, fair, good, and excellent.

How Rare Is A 700 Credit Score?

A 700 credit score is considered good. It falls within the range of good credit scores, which is one of the four broad credit scoring ranges: bad, fair, good, and excellent.

What Is The Best Credit Score Rating?

The best credit score rating falls into four categories: bad, fair, good, and excellent. It is important to know where your score falls to plan accordingly. FICO Scores are calculated based on payment history, amounts owed, new credit, length of credit history, and credit mix.

Conclusion

Understanding credit score ratings is crucial when it comes to managing your financial health. A good credit score opens up opportunities for better interest rates, loan approvals, and overall financial stability. By checking your credit score regularly through reputable platforms like Credit Karma, FICO, and VantageScore, you can stay informed about your financial standing.

Remember that your credit score is influenced by factors like payment history, amounts owed, and length of credit history. Keep these factors in mind and strive for a good credit score to improve your financial future.