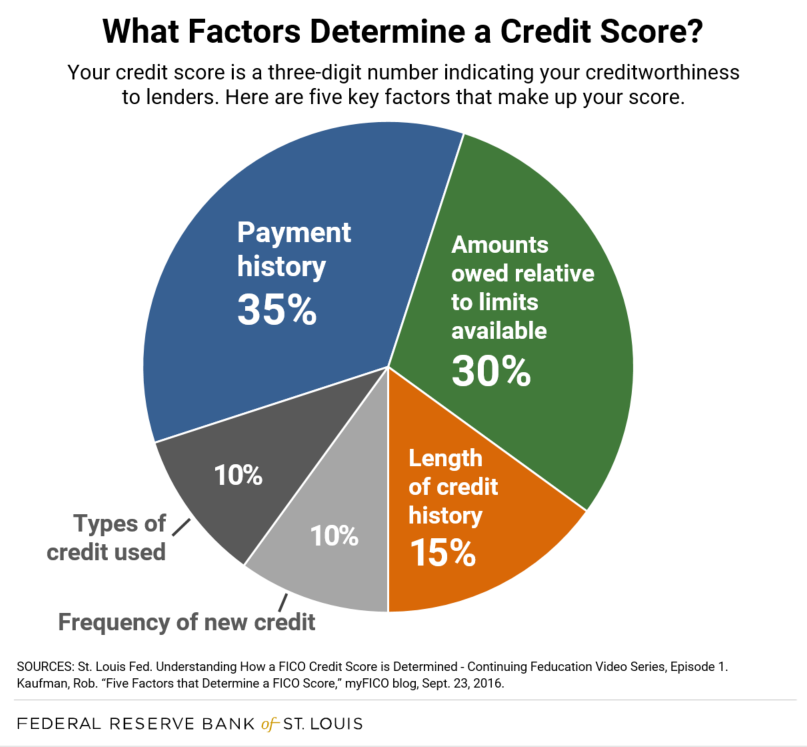

How Credit Scores Work Credit scores are calculated based on five factors: payment history, amount owed, length of credit history, new credit, and credit mix. These factors are used by credit scoring models to determine the creditworthiness of an individual.

Factors such as late payments, outstanding balances, and delinquency are taken into account when calculating credit scores. Improving credit scores can be achieved by paying bills on time, reducing credit card balances, and requesting credit increases. Understanding how credit scores work is essential for individuals to maintain good financial standing and access favorable credit options.

Credit: www.stlouisfed.org

Factors Affecting Credit Scores

A credit score is a numerical representation of your creditworthiness and is influenced by several factors. Understanding these factors can help you improve your credit score and have a positive impact on your financial life.

Payment History

Your payment history is one of the most crucial factors affecting your credit score. Lenders want to see that you make your payments on time consistently. Late or missed payments can negatively impact your credit score and stay on your credit report for up to seven years.

Amount Owed

The amount of money you owe on your credit accounts also plays a significant role in determining your credit score. This factor is commonly referred to as your credit utilization ratio. Keeping your balances low in relation to your credit limits demonstrates responsible credit management and can positively impact your score.

Length Of Credit History

The length of your credit history provides lenders with an understanding of your experience managing credit over time. A longer credit history allows lenders to assess your creditworthiness more accurately. It’s essential to establish and maintain credit accounts, even if you don’t use them regularly, to build a solid credit history.

New Credit

Opening multiple new credit accounts within a short period can raise red flags to lenders. When you apply for new credit, it generates hard inquiries on your credit report, which can temporarily lower your score. It’s important to manage new credit responsibly and avoid opening new accounts unless necessary.

Credit Mix

Your credit mix refers to the variety of credit accounts you have, such as credit cards, loans, and mortgages. Having a diverse mix of credit accounts demonstrates your ability to handle different types of debt responsibly. While it’s not necessary to have every type of credit, a healthy mix can positively impact your credit score.

Calculating Credit Scores

Credit scores, such as the FICO score, are calculated based on several factors including payment history, amount owed, length of credit history, new credit, and credit mix. These factors are used to determine an individual’s creditworthiness and are essential for lenders when assessing loan applications.

Credit Scoring Models

When it comes to calculating credit scores, various credit scoring models are utilized by lenders and credit bureaus. These models analyze the information contained in your credit reports to generate a numerical representation of your creditworthiness.

How Credit Scores Work Reports

Your credit reports play a crucial role in the calculation of your credit scores. These reports, maintained by the major credit bureaus – Experian, TransUnion, and Equifax, contain information about your credit history, including your payment history, credit utilization, length of credit history, and more.

Fico Score Vs. Vantagescore

Two popular credit scoring models are FICO Score and VantageScore. It ranges from 300 to 850, with a higher score indicating better creditworthiness. On the other hand, VantageScore, developed jointly by the three major credit bureaus, has a range of 300 to 850 as well, and is gaining popularity among lenders.

It is essential to regularly check your credit reports for accuracy and maintain a good credit history to ensure a favorable credit score.

Improving Credit Scores

Improving your credit score is essential for obtaining favorable interest rates on loans and credit cards, as well as gaining access to better financial opportunities. Here are three effective strategies to boost your credit score:

Paying Bills On Time

Paying your bills on time is crucial for maintaining a good credit score. Late payments can have a negative impact on your credit history and lower your score. To ensure timely payments, consider setting up automatic bill payments or creating reminders on your phone or calendar. By consistently paying your bills on time, you demonstrate your responsibility as a borrower and increase your creditworthiness.

Reducing Credit Card Balances

High credit card balances can lower your credit score, even if you make your payments on time. Aim to keep your credit card balances below 30% of your credit limit. By reducing your balances, you decrease your credit utilization ratio, which is a significant factor in determining your credit score. Make an effort to pay more than the minimum payment each month to accelerate the repayment process and lower your overall credit card balances.

Requesting Credit Limit Increase

Another strategy to boost your credit score is to request a credit limit increase on your credit cards. This can help lower your credit utilization ratio and demonstrate responsible credit management. Contact your credit card company and ask for a credit limit increase. Remember that increasing your credit limit does not mean you should increase your spending. It is essential to maintain responsible credit card usage and avoid accumulating more debt.

Credit: www.forbes.com

FAQ Of How Credit Scores Work

How Does Credit Scoring Work?

Credit scoring works by analyzing factors such as payment history, amount owed, length of credit history, new credit, and credit mix. Models look at how late payments were, the amount owed, and the frequency of missed payments. Your credit score goes up when you pay bills on time, keep credit card balances low, and maintain a good credit utilization ratio.

How Does Your Credit Score Go Up?

To increase your credit score, make sure to pay your bills on time and keep your overall credit use low by paying down credit card balances. You can also request a credit increase from your credit card company.

What’s A Good Credit Score For A 20 Year Old?

A good credit score for a 20-year-old is typically above 700. It’s important to have a strong credit score as it can impact your ability to get loans and credit cards in the future. To improve your credit score, pay your bills on time and keep your credit utilization low.

Conclusion

Credit scores are a crucial aspect of our financial lives. By understanding how credit scores work and taking steps to improve them, we can open doors to better financial opportunities and secure our financial future.

It’s important to pay our bills on time, keep credit card balances low, and regularly monitor our credit reports for accuracy. Your credit score ultimately reflects your creditworthiness and can greatly impact your ability to obtain loans, secure low interest rates, and even rent a home.

Take control of your credit scores and pave the way for financial success.