To check my business credit score for free, use services like Nav.com or CreditSignal by Dun & Bradstreet. Websites like these offer basic business credit score reporting without charge.

Understanding your business credit score is crucial for securing financing and building trust with suppliers. Your score reflects your company’s financial reliability, impacting loan interest rates and credit terms. Accessing your score for free allows for regular monitoring, keeping you informed about your business’s credit health.

They will give you insights into how lenders and vendors view your company’s creditworthiness. Keeping tabs on your credit score helps in maintaining a positive business financial image and can alert you to any potential issues that need addressing.

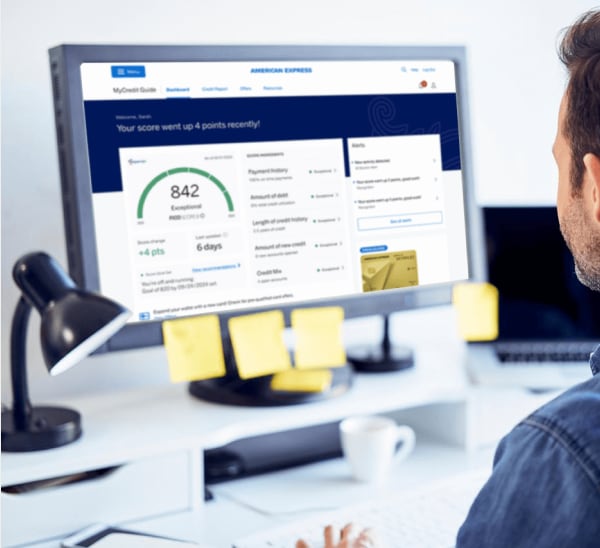

Credit: www.americanexpress.com

Importance Of Monitoring Business Credit Score

Knowing your business credit score is key to financial health. Just like personal credit, it impacts loan approval, interest rates, and insurance premiums for your business. A good score can mean better terms from suppliers and banks. Regular checks help you catch errors and fraud early. Staying informed helps you make wise financial choices for your company.

Why Your Business Credit Matters

Your company’s credibility is gauged by your business credit score. It explains to creditors and suppliers how you handle financial commitments. A high score opens doors to premium financing options. It can even influence business deals and partnerships. Here’s why it matters:

- Secures better loan terms: Banks offer lower interest rates to businesses with strong credit.

- Increases credit capacity: Vendors are more likely to extend credit with favorable terms.

- Enhances company image: A good score builds trust with partners and customers.

- Lowers insurance premiums: Insurers often use credit scores to set premium rates.

Consequences Of Ignoring Your Credit Score

Neglecting your business credit score can lead to challenges. Unmonitored, your score could drop without you knowing. This can cause:

- Higher financing costs: Poor scores lead to higher interest rates on loans.

- Reduced credit lines: Suppliers may cut credit lines or impose strict terms.

- Lost opportunities: Competitors with better scores might win business deals.

- Difficulty in expansion: Limited access to funding can hinder growth.

:max_bytes(150000):strip_icc()/creditrating-96b308227b64470b80235f66c3ec0ce2.jpg)

Deciphering The Business Credit Score

Think of a business credit score as a report card for your company. It shows how well you manage business finances. Lenders, suppliers, and potential business partners look at this score to decide if they want to work with you. Let’s unlock what your business credit score is all about.

Components Of A Business Credit Score

- Payment History: Do you pay bills on time?

- Credit Utilization: How much of your credit line do you use?

- Debt and Debt Usage: What is your total debt? How do you handle it?

- Company Size: This is about how big your business is.

- Industry Risk: Some industries are riskier than others.

Difference Between Personal And Business Credit

| Personal Credit Score | Business Credit Score |

|---|---|

| Ranges from 300-850 | Typically ranges from 0-100 |

| Based on personal debts and payment history | Focuses on business debts and transactions |

| Legal requirements to access someone’s score | More public and easier to access |

Free Options To Check My Business Credit Score

Understanding your business credit score is crucial for financial health. Many services and tools offer free access to your score. Identify areas for improvement and monitor your business credit without spending a dime. Explore free options like specialized websites, credit card providers, and lenders.

Check my business credit score online

Checking your business credit score online has never been easier, providing entrepreneurs with a convenient and efficient way to assess their financial standing. Through various online platforms and credit reporting agencies, businesses can access crucial information regarding their creditworthiness.

Monitoring your business credit score is essential for making informed financial decisions, securing favorable terms with vendors and lenders, and establishing a solid foundation for future growth.

With just a few clicks, business owners can gain insights into their credit history, identify areas for improvement, and ensure that their financial profile reflects positively on their company.

Websites Offering Free Business Credit Reports

Several online platforms provide complimentary business credit reports. They usually partner with credit bureaus. You might need to sign up for an account.

- Nav: Access a basic version of your credit report at no cost.

- Credit Signal by Dun & Bradstreet: Get alerts for changes in your score.

- Creditsafe: Try their service with a free business credit report.

Using Credit Cards And Lenders For Free Access

Credit cards and lending companies often include credit monitoring tools. Examine your agreements or ask the providers about these perks.

| Provider | Service |

|---|---|

| American Express | Free business credit scores for cardholders. |

| Chase | Chase Ink cardholders can access their score. |

| Barclays | Monitor your credit score free of charge. |

Some banks offer similar services for account holders. Check with your business bank for these options.

Credit: www.investopedia.com

Understanding Your Business Credit Report

Think of your business credit report as a report card for your company’s finances. It showcases your business’s creditworthiness to lenders, suppliers, and other interested parties. Utility companies, Insurance firms, and even clients might peek at it. Knowing what’s on it can help you better manage your business’s financial reputation and opportunities for growth.

Interpreting The Scores And Ratings

Scores and ratings are the heart of a business credit report. They help others gauge how risky it might be to work with your business. A higher score often means lower risks

- Paydex Score – Dun & Bradstreet’s scoring system that rates how well a business pays its bills.

- Credit Risk Score – Predicts your business’s chance of becoming severely delinquent on payments.

- FICO SBSS – A common loan application tool that combines personal and business credit into a single score.

A score can range greatly. Each agency has its own metrics. Strive for a high score to benefit from better credit terms.

Identifying Errors And Uncommon Activity

Errors or fraud can harm your credit standing. Regular checks are crucial. This allows you to spot and resolve any inaccuracies promptly.

Look for:

- Unfamiliar debts listed

- Incorrect credit limits or account statuses

- Outdated business information

Dispute inaccuracies with the relevant credit bureau right away. This maintenance keeps your report true and your credit score accurate.

Improving And Maintaining A Healthy Business Credit

Building a strong business credit score opens doors to better financing options. A good score signals credibility to suppliers, lenders, and potential partners. To keep your business credit in top shape, adopt effective strategies. Timely payments, debt management, and regular monitoring are key.

Best Practices For Credit Management

To safeguard your business credit score, embrace these best practices:

- Pay bills on time: Prompt payment boosts your credit reputation.

- Reduce debt: Lower debt levels help improve your credit score.

- Monitor credit reports: Check regularly for inaccuracies or fraud.

- Establish credit lines: Smart use of credit lines shows responsible credit use.

- Limit credit inquiries: Too many checks can harm your score.

When To Consider Professional Credit Repair

Seek pro help when facing these challenges:

- Errors on your credit report are frequent.

- Dings on your credit seem unfixable on your own.

- Understanding credit laws feels overwhelming.

A good credit repair firm will offer guidance and manage disputes with credit agencies.

Legal Rights And Responsibilities

Understanding your legal rights and responsibilities is a key part of managing your business credit score. Below, explore the role of the Fair Credit Reporting Act and how to address inaccuracies on your report.

Fair Credit Reporting Act (FCRA) And Your Business

FCRA protects businesses by overseeing how credit information is gathered and used. It ensures that credit bureaus furnish correct and complete information that respects your privacy.

- You have the right to a free report annually from major bureaus.

- Bureaus must investigate disputes within 30 days.

- Unauthorized access to your credit report is illegal.

- Limits are set on who views your credit score.

Addressing Inaccuracies In Your Report

Spot an error? Take charge with these steps:

- Review your report carefully for any mistakes.

- Contact the bureau directly to report errors.

- Provide documents that support your claim.

- Follow up to ensure corrections are made.

Staying informed and attentive maintains your report’s integrity and supports your financial health.

Frequently Asked Questions On How To Check My Business Credit Score Free

Is Checking Business Credit Score Free Possible?

Yes, it is possible to check your business credit score for free. Certain credit bureaus and financial service platforms offer free basic reports that provide a snapshot of your business’s credit standing.

What Factors Influence My Business Credit Score?

Several factors influence your business credit score, including payment history, credit utilization, company size, industry risk, and the length of credit history. Consistent, timely payments and low credit utilization can improve your score.

How Often Should I Check My Business Credit Score?

Regular monitoring is key, so checking your business credit score at least annually is advised. However, if you’re planning to apply for a loan or expect changes in your credit activities, reviewing more frequently can be beneficial.

Can Personal Credit Affect My Business Credit Score?

Yes, personal credit can affect your business credit score, especially if you’re a sole proprietor or if your business credit history is limited. Personal guarantees on business loans can also link to your credit.

Conclusion

Understanding your business credit score is critical for your company’s fiscal health. By utilizing the resources discussed, you can review your score without cost. Remember, regular checks keep you informed and ready for future opportunities. Take charge of your credit, and pave the way for your business’s success.

s

s