The mortgage credit score is a specific credit score used by lenders to assess the creditworthiness of individuals applying for a mortgage loan. It focuses on factors such as payment history, credit utilization, and credit mix to determine if the borrower poses a good risk and can afford the mortgage payment.This score helps lenders decide the interest rate and terms of the mortgages loan.

Understanding Mortgage Credit Score

A mortgage credit scores is a numerical representation of an individual’s creditworthiness when it comes to obtaining a home loan. It is a three-digit number that lenders use to assess the risk of lending money to a borrower for the purpose of financing a house. Understanding this score is crucial for anyone looking to purchase a home as it plays a vital role in determining the terms and conditions of a mortgage.

Definition Of Mortgage Credit Score

A mortgage credit scores is a specific type of credit scores that is used by lenders to evaluate a borrower’s creditworthiness in relation to their ability to repay a mortgages loan. It is based on several factors, including the borrower’s payment history, credit utilization, length of credit history, credit mix, and recent credit inquiries. The most common credit scoring models used by mortgage lenders are the FICO Scores and the VantageScore.

Importance Of Mortgage Credit Score

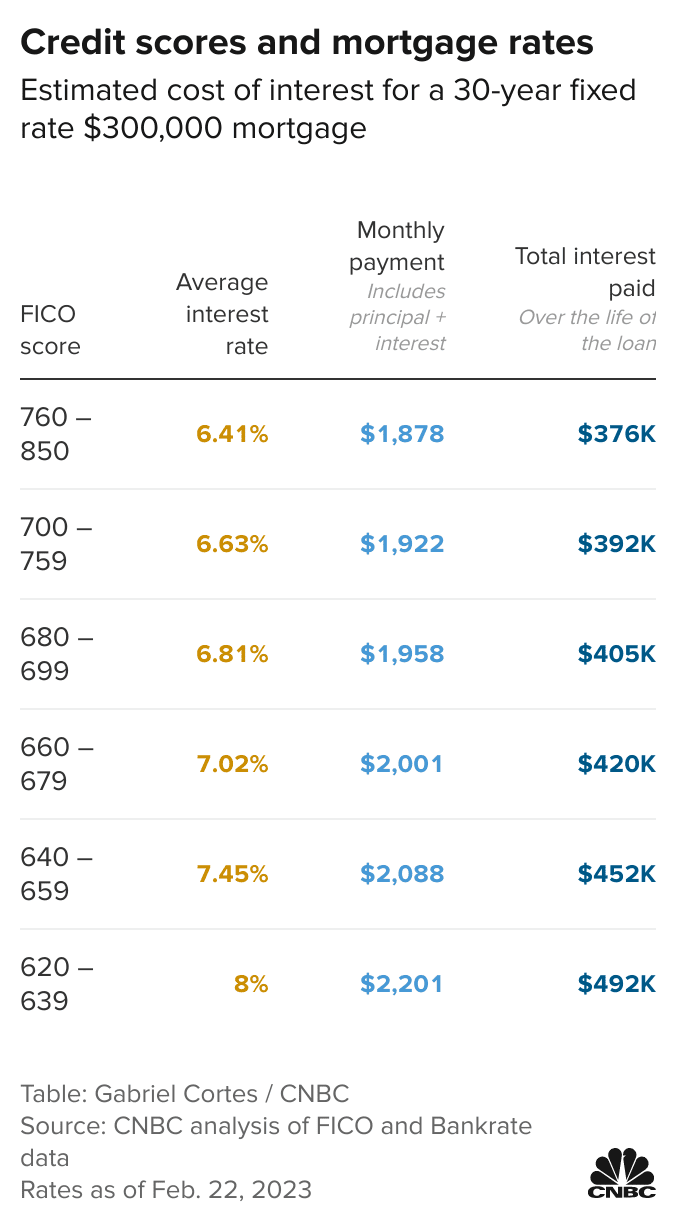

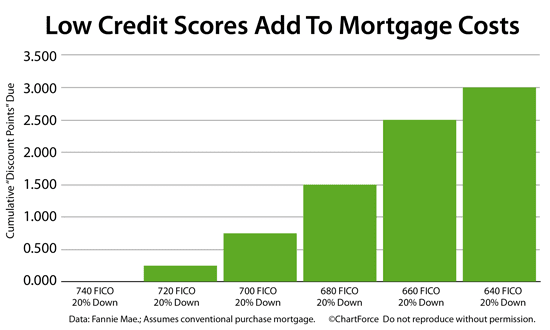

The mortgage credit scores plays a crucial role in the home loan approval process. Lenders use this score to determine the borrower’s level of risk and decide whether to approve their mortgage application. A higher credit score indicates a lower risk, making it easier to qualify for a loan with more favorable terms, such as a lower interest rate and a smaller down payment. On the other hand, a lower credit score may result in higher interest rates, larger down payments, or even denial of the mortgages application.

Having a good mortgage credit scores is essential not only for obtaining a mortgages but also for saving money over the long term. With a higher credit score, borrowers can secure lower interest rates, which can lead to significant savings over the life of the loan. A good credit score also gives borrowers greater negotiating power and the ability to choose from a wider range of loan options. Therefore, it is crucial for individuals looking to purchase a home to understand and actively work towards maintaining a good mortgage scredit score.

Factors Affecting Mortgage Credit Score

When it comes to applying for a mortgages, your credit scores plays a critical role. Lenders use your credit score to assess your creditworthiness and determine whether you qualify for a loan and what interest rate you will be offered.

Payment History

Your payment history has a significant impact on your mortgage credit scores. Lenders want to see a consistent pattern of on-time payments for your debts, including credit cards, auto loans, and previous mortgages. Any late payments, defaults, or bankruptcies can negatively impact your score and make it harder to secure a mortgage loan. It is crucial to make your payments on time every month to maintain a high credit score.

Credit Utilization

Credit utilization refers to the percentage of your available credit that you are currently using. Lenders prefer to see a low credit utilization ratio as it demonstrates responsible credit management. It is recommended to keep your credit utilization below 30% to maintain a good credit score. Paying off your balances in full every month and avoiding maxing out your credits cards can help improve your credits utilization and boost your mortgage credit scores.

Credit Mix

The diversity of your credits accounts also plays a role in your mortgage credit scores. Lenders want to see a mix of different types of credit, such as credit cards, auto loans, student loans, and mortgages. Having a varied credit mix demonstrates your ability to manage different types of debt responsibly. However, it is important to note that opening new accounts solely to diversify your credit mix can have a negative impact on your credit score. Only open new accounts when necessary and manage them responsibly.

Minimum Credit Score For Mortgage

When applying for a mortgage, one of the key factors that lenders consider is your credit scores. A credit score is a numerical representation of your creditworthiness and indicates how likely you are to repay your debts on time. The minimum credit scores required for a mortgages varies depending on the lender and the type of loan you are applying for. In this article, we will explore the lender requirements and credit scores ranges to help you understand what credit score you need to qualify for a mortgages.

Lender Requirements

Each lender has its own set of requirements when it comes to the minimum credit score for a mortgages. While some lenders may be flexible and consider applicants with lower credit scores, others have stricter criteria and may only approve borrowers with higher credit scores. It’s important to research different lenders and compare their requirements to find the one that best suits your situation.

Credit Score Ranges

Credit scores are typically measured on a scale ranging from 300 to 850. The higher your credit score, the better your chances of getting approved for a mortgage and securing favorable interest rates. Here are the general credit score ranges for mortgages:

It’s important to note that these ranges are general guidelines and may vary slightly between lenders. Additionally, other factors such as your income, employment history, and debt-to-income ratio will also be taken into consideration when determining your eligibility for a mortgage.In conclusion, the minimum credit score required for a mortgage varies depending on the lender and the type of loan you are applying for. It’s essential to research lender requirements and aim for a higher credit score to increase your chances of getting approved for a mortgage with favorable terms. Remember to check your credit score regularly and take steps to improve it if necessary.

| Excellent Credit | 760 and above |

| Good Credit | |

| Fair Credit | 640-699 |

| Poor Credit | 580-639 |

| Bad Credit | 579 and below |

Credit: www.cnbc.com

Improving Mortgage Credit Score

To improve your chances of getting a mortgage, focus on enhancing your mortgage credit score. Lenders use this score to evaluate your credit risk and determine the interest rate for your home loan. Factors like payment history, credit utilization, and credit mix influence your mortgage credit score.

Managing Debt

One of the key factors that can improve your mortgage credit score is effectively managing your debt. Lenders want to see that you have a responsible borrowing history and are capable of handling your financial obligations. To do this, focus on paying down your existing debts, such as credit card balances or personal loans. By reducing your debt-to-income ratio, you demonstrate to lenders that you are a low-risk borrower.

Timely Payments

Making timely payments is crucial for improving your mortgage credit score. Your payment history is a significant factor that lenders consider when assessing your creditworthiness. Late or missed payments can have a negative impact on your credit score. To avoid this, set up automatic payments or set reminders for yourself to ensure that your bills are paid on time. Consistent and punctual payments demonstrate to lenders that you are financially responsible and can be trusted to make timely mortgage payments.

Credit Report Monitoring

Regularly monitoring your credit report is essential for maintaining and improving your mortgage credit score. By staying up-to-date with your credit report, you can identify any errors or discrepancies that could negatively affect your score. Additionally, monitoring your credit report allows you to detect any fraudulent activity or identity theft. You can request a free copy of your credit report annually from the three major credit bureaus. Review your report thoroughly and report any inaccuracies promptly to ensure the accuracy of your credit score.

Applying For A Mortgage

Applying for a mortgage can be both an exciting and nerve-wracking experience. One of the key factors that lenders consider during the mortgage approval process is the applicant’s credit score. Your credit score plays a crucial role in determining your eligibility for a mortgage and the terms you may qualify

Credit: www.michaeladeery.com

Frequently Asked Questions For What Is The Mortgage Credit Score

Which Fico Score Do Mortgage Lenders Use?

Mortgage lenders typically use FICO scores to evaluate your credit risk. They consider your payment history, credit utilization, and credit mix to determine your eligibility and interest rate. It’s important to have a good credit score to secure a mortgage.

What Credit Score Is Needed For A Mortgage?

The credit score needed for a mortgage depends on the lender, but generally a score of 620 or higher is required.

What Credit Score Gets A Good Mortgage Rate?

A good credit score for getting a good mortgage rate is typically 740 or higher.

What Credit Score Is Needed To Buy A $300 K House?

A credit score of around 620 or higher is typically needed to qualify for a mortgage to buy a $300k house.

Conclusion

To sum it up, the mortgage credit score is crucial when applying for a home loan. Lenders use this score to assess your credit risk and determine the interest rate you will be charged. It is based on your payment history, credit utilization, and credit mix.

Having a good mortgage credit score demonstrates that you are a reliable borrower capable of making mortgage payments. It is essential to keep track of your credit score and improve it if necessary to increase your chances of securing a favorable mortgage rate.