To maintain a good credit score, you must make timely payments and keep your credit utilization low. Additionally, regularly monitor your credit report and avoid opening multiple new accounts in a short period.

Having a good credit score is essential for securing loans, mortgages, and favorable interest rates. It reflects your financial responsibility and can impact various aspects of your life, including renting an apartment and getting insurance. By following good credit habits, you can build a solid financial foundation for the future.

Remember, a good credit score is a valuable asset that requires consistent effort to maintain.

Understanding Credit Scores

Understanding credit scores is crucial for maintaining financial stability and achieving long-term financial goals. A good credit score serves as a key indicator of your financial health and impacts your ability to access credit, secure loans, and make significant purchases.

Importance Of Credit Scores

Credit scores are essential for obtaining loans and determining interest rates. They reflect your creditworthiness and financial responsibility, influencing various aspects of your financial life.

Factors Affecting Credit Scores

- Payment history: Timely repayment of debts is crucial.

- Credit utilization: Keep credit utilization low to maintain a good score.

- Length of credit history: Longer credit history reflects stability.

- New credit: Limit new credit applications to prevent negative impacts.

- Credit mix: Having a diverse mix of credit types can be beneficial.

Power Strategy 1: Timely Payments

Setting Up Automatic Payments

Setting up automatic payments is a convenient way to ensure you never miss a due date.

- Automatic payments can simplify your bill payments.

- This method helps in avoiding late fees and penalties.

Importance Of Paying On Time

Paying your bills on time is critical to keeping a decent credit score.

- Timely payments demonstrate financial responsibility.

- Avoiding late payments helps build trust with lenders.

Power Strategy 2: Credit Utilization

When it comes to maintaining a good credit score, understanding and managing your credit utilization is crucial. Credit utilization refers to the amount of credit you’re using compared to the total credit limit available to you. Keeping this ratio low can have a significant impact on your credit score. Let’s dive into the details of credit utilization and strategies to maintain a low credit utilization ratio.

Understanding Credit Utilization Ratio

Your credit utilization ratio is calculated by dividing the total amount of credit you are currently using by the total credit limit available to you. For example, if you have a credit card with a $5,000 limit and you have a balance of $1,000, your credit utilization ratio would be 20%.

Strategies To Maintain Low Credit Utilization

- Keep your credit card balances low to ensure a low credit utilization ratio.

- Monitor your credit usage on a regular basis, aiming to maintain it under 30%.

- If possible, request a credit limit increase to lower your utilization ratio.

- Consider spreading your purchases across multiple credit cards to keep individual card balances low.

Power Strategy 3: Diversifying Credit Accounts

When it comes to maintaining a good credit score, diversifying your credit accounts is a powerful strategy that can significantly impact your creditworthiness. By having different types of credit accounts and managing them responsibly, you can demonstrate to lenders that you are a reliable borrower. This not only strengthens your credit profile but also opens doors to better financial opportunities. In this section, we will explore the types of credit accounts you can have and the benefits of diversifying your credit portfolio.

Types Of Credit Accounts

There are various types of credit accounts that you can consider adding to your credit mix. Here are some of the most common options:

| Types of Credit Accounts | Description |

|---|---|

| 1. Credit Cards | These are revolving credit accounts that allow you to borrow money up to a certain credit limit, which you can repay in full or make minimum payments. |

| 2. Installment Loans | These are fixed-term loans where you borrow a specific amount and repay it in equal monthly installments over a set period of time. |

| 3. Mortgages | A mortgage is a loan specifically used to finance the purchase of a home. It is repaid over a long period, typically 15 to 30 years. |

| 4. Auto Loans | Auto loans are used to finance the purchase of a vehicle. They have specific terms and repayment schedules. |

| 5. Personal Loans | Personal loans are unsecured loans that can be used for various purposes, such as consolidating debt or funding home improvements. |

Benefits Of Diversification

Diversifying your credit accounts offers several benefits that play a crucial role in maintaining a good credit score:

- Enhanced Credit Mix: Having a mix of different credit accounts can demonstrate your ability to handle various types of debt responsibly. This can boost your creditworthiness in the eyes of lenders.

- Lower Credit Utilization: Increasing the number of available credit accounts can lower your credit utilization ratio. This ratio is calculated by dividing your total credit card balances by your total credit limits. A lower credit utilization ratio can positively impact your credit score.

- Improved Payment History: By managing multiple credit accounts and making timely payments on all of them, you establish a strong payment history, showing lenders that you are reliable and prompt in repaying your debts.

- Increased Financial Flexibility: Diversifying your credit accounts can provide you with more financial options. You will have access to different types of credit that can help you achieve your goals, whether it’s buying a car, purchasing a home, or covering unexpected expenses.

- Greater Control: With a diversified credit portfolio, you have a better control over your overall financial health. You can strategically manage your different accounts, leverage favorable interest rates, and optimize your credit utilization.

By diversifying your credit accounts, you can strengthen your credit profile, maximize your credit score, and position yourself as a responsible borrower in the eyes of lenders. Remember to manage your credit accounts wisely and make timely repayments to reap the full benefits of diversification.

Power Strategy 4: Regular Monitoring

Maintaining a good credit score is an ongoing process that requires regular monitoring. By keeping a close eye on your credit reports, you can ensure that your financial information is accurate and up to date. Regular monitoring allows you to identify and dispute any errors or discrepancies that may be affecting your credit score negatively. In this section, we will explore two essential steps in the monitoring process: reviewing credit reports and identifying and disputing errors.

Reviewing Credit Reports

Reviewing your credit reports on a regular basis is a crucial step in maintaining a good credit score. Your credit reports provide a detailed overview of your borrowing history and financial behavior. By examining your reports, you can identify any potential issues or inconsistencies that may need to be addressed.

To review your credit reports, follow these steps:

- Obtain copies of your credit reports from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

- Thoroughly examine the information on each report, paying particular attention to your personal details, account balances, payment history, and any reported delinquencies or collections.

- Keep an eye out for any unfamiliar accounts or inquiries, as these may indicate identity theft.

- Highlight any errors or discrepancies you discover during your review process, as these can impact your credit score.

Identifying And Disputing Errors

Once you have reviewed your credit reports, the next step is to identify and dispute any errors you have found. Discrepancies in your credit information can have a negative impact on your creditworthiness, so it’s essential to address them promptly. Here’s how to identify and dispute errors:

- Identify any errors or inaccuracies on your credit reports, such as incorrect personal information, inaccurate account balances, or fraudulent activity.

- Gather supporting documentation that can help prove the errors. This may include billing statements, payment receipts, or correspondence with creditors.

- Submit a written dispute to the credit bureau(s) in question. Include a detailed explanation of the error and any supporting documents.

- Follow up with the credit bureau(s) to ensure your dispute is being processed and resolved. Request a revised credit report once the corrections have been made.

Regularly monitoring your credit reports and promptly addressing any errors is an effective way to maintain a good credit score. By being proactive in reviewing and disputing inaccuracies, you can ensure that your creditworthiness is accurately reflected and increase your chances of securing favorable credit terms in the future.

Power Strategy 5: Responsible Credit Applications

Impact Of Multiple Inquiries

Applying for credit should be done wisely to prevent negative impacts on your credit score. Multiple credit inquiries within a short period can have a damaging effect on your score. Each credit application results in a hard inquiry on your credit report, which can indicate that you are seeking credit and may be a higher credit risk.

Applying For Credit Wisely

When applying for credit, it’s crucial to do so wisely. Each application should be carefully considered to prevent unnecessary hard inquiries. Only apply for credit when you have a genuine need and are confident that you meet the eligibility criteria. Consider researching and comparing different credit options before making a decision.

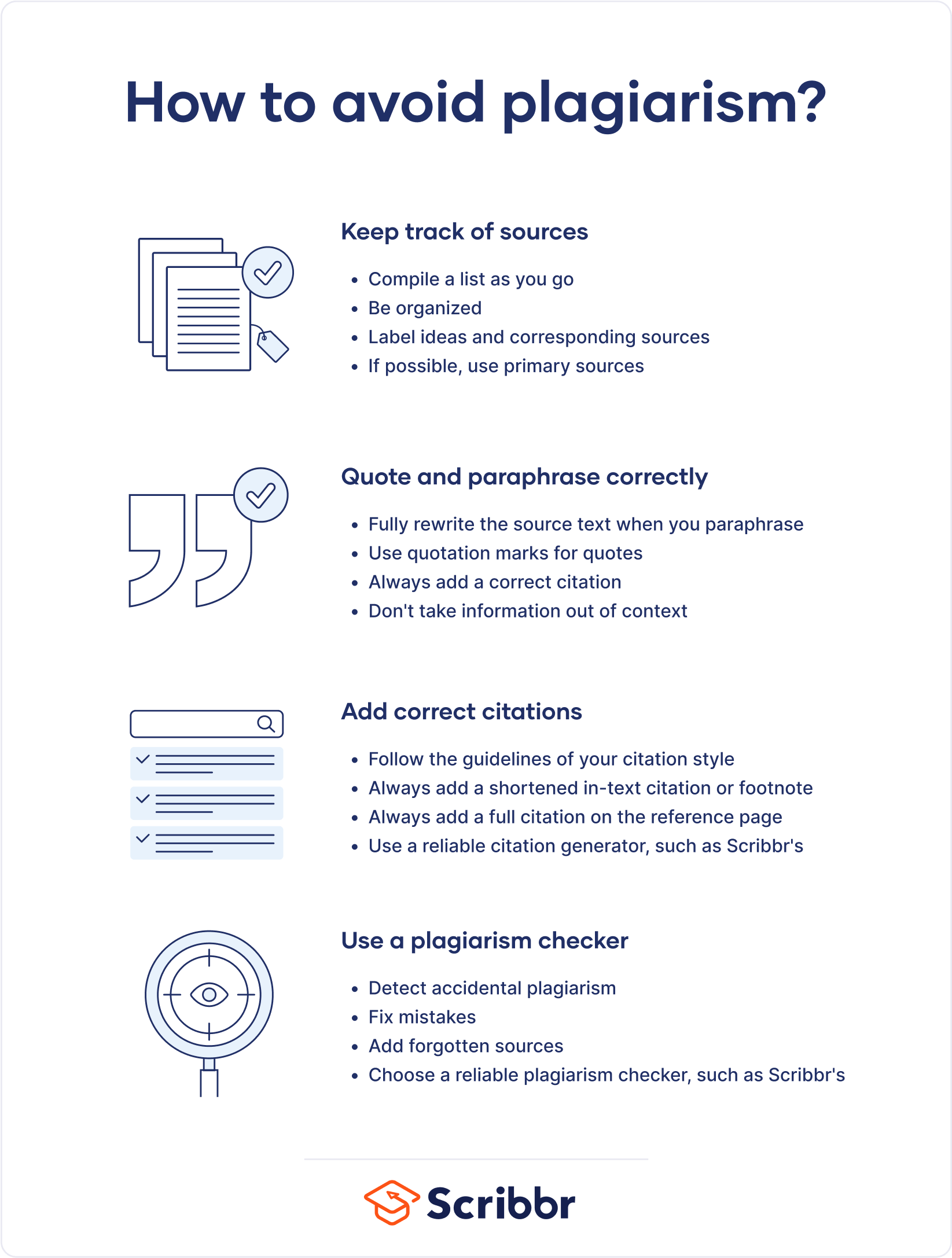

Credit: www.scribbr.com

Frequently Asked Questions Of To Maintain A Good Credit Score You Must

How Can I Maintain A Good Credit Score?

To maintain a good credit score, you must pay your bills on time, keep your credit utilization low, regularly check your credit report for errors, avoid opening too many new accounts, and minimize credit card balances.

Why Is It Important To Maintain A Good Credit Score?

Maintaining a good credit score is important because it gives you access to better loan terms, lower interest rates, and increased financial opportunities. A good credit score also reflects financial responsibility, which can positively impact your chances of getting approved for credit in the future.

Does Closing A Credit Card Affect My Credit Score?

Closing a credit card can potentially lower your credit score. It can increase your credit utilization ratio and shorten your overall credit history, which are factors that can impact your credit score. However, if closing the card helps you avoid high fees or temptation to overspend, it may be worth considering.

How Long Does It Take To Improve A Credit Score?

Improving a credit score takes time and depends on various factors. Generally, it takes around six months of responsible credit behavior to see noticeable improvements in your score. However, significant improvements can take one to two years or even longer, depending on your individual circumstances.

Conclusion

In order to maintain a good credit score, it is essential to practice financial responsibility, make timely payments, and regularly monitor your credit report. By understanding the factors that impact your score and consistently managing your finances, you can achieve and sustain a healthy credit standing.

Taking proactive steps can lead to long-term financial stability and access to better opportunities.