To check your credit score free, visit AnnualCredit Report.com and request a free copy of your credit report from each of the three major consumer reporting companies (Equifax, Experian, and TransUnion). You can also check your credit score without it affecting your credit by using services like Credit Karma or by checking with your credit card issuer or bank.

Additionally, it’s important to note that personally checking your credit score or credit report does not impact your score, but applying for credit can result in a small decrease.

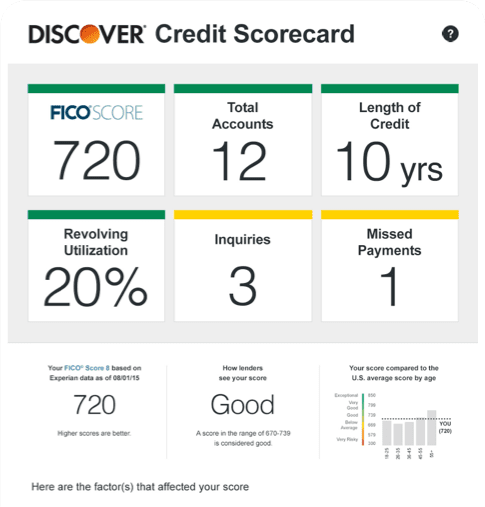

Credit: www.discover.com

Why Check Credit Score For Free

Obtain a free credit score check without any impact on your credit by visiting AnnualCreditReport. com. Take advantage of this opportunity to monitor your credit and ensure financial stability.

Importance Of Checking Credit Score

Your credit score plays a significant role in determining your financial stability. It is a reflection of your creditworthiness and is used by lenders, landlords, and even potential employers to assess your reliability. Checking your credit score regularly is important because:

- It helps you understand where you stand financially and identify areas for improvement.

- It allows you to detect any errors or discrepancies in your credit report, which can negatively impact your score.

- It helps you track your progress in building and maintaining good credit.

- It enables you to identify potential red flags or signs of identity theft.

Benefits Of Checking Credit Score For Free

There are several benefits to checking your credit score for free, including:

- Cost-effective: Checking your credit score for free saves you money, as you don’t have to pay for credit monitoring services or purchase credit reports.

- Easy accessibility: With the availability of online tools and resources, checking your credit score has never been easier. You can access your credit score anytime, anywhere, without any hassle.

- Early detection of issues: Regularly checking your credit score allows you to identify and address any issues or discrepancies early on. This gives you the opportunity to take necessary steps to improve your credit standing.

- Empowerment: By checking your credit score for free, you gain knowledge and understanding of your financial situation. This empowers you to make informed decisions about your finances and take steps towards achieving your financial goals.

In conclusion, checking your credit score for free is crucial for maintaining good financial health. It not only helps you understand where you stand financially but also provides you with the necessary information to improve your creditworthiness. Take advantage of the readily available resources and start monitoring your credit score for free today.

How To Check Credit Score For Free

Checking your credit score is an essential step in managing your finances and ensuring your financial health. Fortunately, there are several ways to check your credit score for free. In this article, we will explore three reliable methods that allow you to access your credit score without any cost.

Annualcreditreport.com

One of the most trusted sources for free credit reports is AnnualCreditReport.com. This website allows you to request a free copy of your credit report from each of the three major consumer reporting companies – Equifax, Experian, and TransUnion – once every year. By visiting AnnualCreditReport.com, you can easily access your credit report and review your credit score without spending a dime. It is crucial to note that AnnualCreditReport.com is the only website authorized by federal law to provide these free credit reports.

Credit Card Issuers And Banks

Many credit card issuers and banks offer free credit scores to their customers. By logging into your online account, you can often find a section dedicated to your credit score. Whether it’s your FICO score or VantageScore, these credit scores provide valuable insights into your creditworthiness and can be accessed without any negative impact on your credit. Checking your credit score directly through your credit card issuer or bank allows you to stay updated on any changes in your credit profile and take appropriate actions to improve it.

Credit Score Checking Websites

In addition to AnnualCreditReport.com and credit card issuers/banks, there are various websites where you can check your credit score for free. These websites aggregate data from multiple credit reporting agencies and provide you with an estimated credit score. While these scores may not be as accurate as the ones provided by credit card issuers or banks, they still give you a general idea of your credit health. Some popular credit score checking websites include Credit Karma, Experian, and NerdWallet.

It’s important to note that checking your own credit score through any of these methods will not have a negative impact on your credit. However, it’s essential to be cautious of scams or websites that may charge you for accessing your credit score. Stick to trusted sources like AnnualCreditReport.com and reputable credit card issuers/banks to ensure your credit score is accurate and reliable.

Understanding And Improving Credit Score

Having a good credit score is crucial for financial success. A credit score is a three-digit number that represents an individual’s creditworthiness and is used by lenders to determine their eligibility for loans, credit cards, and other financial products.

What Constitutes A Good Credit Score

A good credit score typically falls within the range of 670 to 850, according to the commonly used FICO scoring model. A higher credit score indicates a lower credit risk, making it easier to obtain favorable interest rates and loan approvals.

| Score Range | Credit Category |

|---|---|

| 800 – 850 | Exceptional |

| 740 – 799 | Very good |

| 670 – 739 | Good |

Factors That Affect Credit Score

Several factors contribute to the calculation of an individual’s credit score. These factors include:

- Payment history: Timely payments contribute positively to your credit score, while late or missed payments can have a negative impact.

- Credit utilization: The amount of credit you are using in relation to your available credit limit can affect your credit score. It is generally advisable to keep your credit utilization below 30%.

- Length of credit history: The length of time you have been using credit can influence your credit score. A longer credit history might improve your score.

- Credit mix: Having a good mix of credit types, such as credit cards, loans, and a mortgage, can positively impact your credit score.

- New credit applications: Frequent credit applications within a short period can raise concerns for lenders and potentially lower your credit score.

Tips For Improving Credit Score

If your credit score is not where you want it to be, there are steps you can take to improve it. Consider the following tips:

- Pay your bills on time: Consistently making payments by the due date will help establish a positive payment history.

- Reduce your credit utilization: Aim to keep your credit card balances below 30% of your available credit limit.

- Monitor your credit report: Regularly check your credit report for errors or inaccuracies that could be negatively impacting your score. Dispute any incorrect information.

- Avoid closing old credit accounts: Keeping older accounts open can help maintain a longer credit history, which can positively impact your score.

- Limit new credit applications: Refrain from applying for multiple credit cards or loans within a short period to avoid potential negative impacts on your score.

By understanding what constitutes a good credit score, the factors that can affect it, and implementing strategies to improve it, individuals can take control of their financial health and improve their chances of accessing favorable credit options.

Frequently Asked Questions For Check Credit Score Free

How Can I Safely Check My Credit Score For Free?

To safely check your credit score for free, visit AnnualCreditReport. com to request a free copy of your credit report from Equifax, Experian, and TransUnion once a year. You can also check your credit score without affecting it by using services like Credit Karma or by checking with your credit card issuer or bank.

Avoid hard inquiries when applying for credit, as they may lower your score.

How Can I Get My Fico Score For Free?

To get your FICO score for free, you can visit AnnualCreditReport. com and request a free copy of your credit report from Equifax, Experian, and TransUnion once per year. Some credit card issuers and banks also provide free credit scores to their customers.

Checking your own credit score won’t affect it.

How Can I Check My Credit Score Without It Going Up?

To check your credit score without it going up, you can request one free copy of your credit report annually from Equifax, Experian, and TransUnion at AnnualCreditReport. com. Many credit card issuers and banks also provide free credit scores to their customers.

Checking your own credit score or report won’t affect it, but applying for credit may result in a slight decrease.

What Is A Decent Credit Score?

A decent credit score is a score that falls within a good range, typically above 670. This score indicates that you have a history of responsibly managing your credit. It’s important to maintain a decent credit score as it can help you qualify for loans and secure favorable interest rates.

Conclusion

Checking your credit score for free is easy and hassle-free. You have the right to request a free copy of your credit report once a year from the major consumer reporting companies. Many credit card issuers and banks also provide free credit scores to their customers.

Checking your own credit score won’t affect it, so you can do it as often as you like. Remember, knowing your credit score is crucial for financial stability. Take advantage of the resources available to stay informed and in control of your credit health.