If you have a 600 credit score, consider secured credit cards to rebuild credit and increase your score over time. Secured credit cards require a security deposit upfront, which serves as collateral for the credit limit granted.

Building credit with a 600 score is a gradual process, but using a secured credit card responsibly can help improve your creditworthiness and access to better credit offers in the future. With consistent on-time payments and responsible credit utilization, you can work towards achieving a higher credit score and qualifying for more favorable credit terms.

Be patient and diligent in managing your secured card to see positive results in your credit profile.

Credit: www.bankrate.com

Understanding the 600 Credit Score

Discover credit card options tailored for individuals with a 600 credit score. Learn how to maximize the benefits and minimize the drawbacks of having a 600 credit score, and find the right credit cards to improve your financial position.

Understanding the 600 Credit Score:

What is a 600-credit Credit Score?

A 600 credit score indicates fair credit, with room for improvement. It falls between poor and good credit ratings.

How Does a 600 Credit Score Affect Credit Card Approval?

A 600 credit score may limit your access to top-tier credit card offers, but secured or subprime cards are still available.

In general, a credit score of 600 can impact your credit card approval by resulting in higher interest rates or lower credit limits.

Credit card issuers may require a larger security deposit for secured cards with a 600 credit score, but approval is usually more achievable.

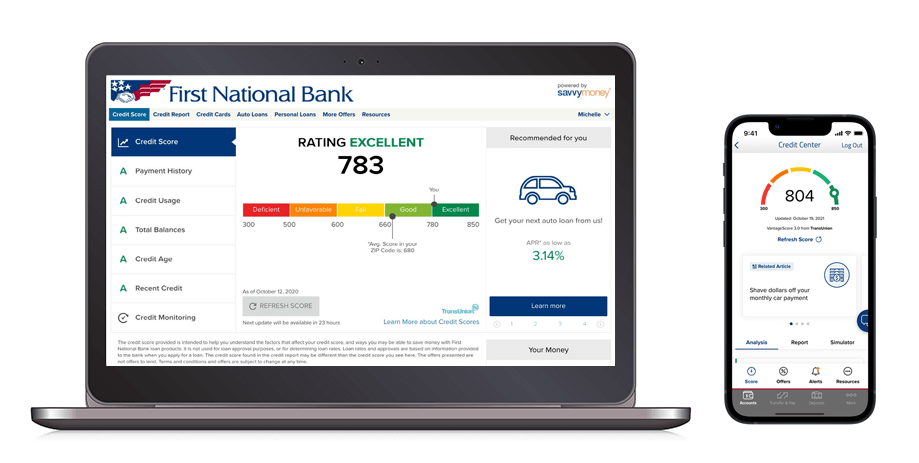

Credit: www.fnb-online.com

Challenges of Getting a Credit Card With a 600 Credit Score

Challenges of Getting a Credit Card with a 600 Credit Score

Limited options are available

Obtaining a credit card with a credit score of 600 poses significant hurdles due to limited choices.

Higher Interest Rates and Fees

Expect to encounter increased interest rates and fees with a credit score of 600.

Improving Your Credit Score

Discover how credit cards tailored for a 600 credit score can help improve your credit standing. These specialized cards offer opportunities to rebuild credit and demonstrate responsible financial habits. By using them wisely, you can boost your credit score over time and access better financial products.

Improving Your Credit Score

It’s essential to keep an eye on your credit score, especially if you’re considering applying for a credit card with a 600 credit score. Improving your credit score is key to accessing better financial opportunities and securing more favorable terms. Below are some crucial areas to focus on when it comes to enhancing your credit score:

Payment History

Maintaining a spotless payment history is essential to elevating your credit score. Ensure that you consistently pay your bills on time to exhibit responsible credit management. Late payments can significantly impact your creditworthiness, so setting up automatic payments or payment reminders can be a great way to stay on track.

Credit Utilization Ratio

Your credit utilization ratio is the percentage of credit you use relative to your total available credit. To improve your credit score, aim to keep this ratio below 30%. Lowering your credit card balances can help bring down your credit utilization ratio, positively impacting your credit score.

Credit-Building Techniques

Implementing proven credit-building techniques can help you gradually boost your credit score. Consider becoming an authorized user on a family member’s credit card, applying for a secured credit card, or taking out a credit-builder loan. These strategies can demonstrate responsible credit management and contribute to an improved credit profile.

Credit: secny.org

Best Credit Cards for a 600 Credit Score

Looking for the finest credit cards with a 600 credit score? With a credit score of 600, you may face some challenges when it comes to getting approved for certain credit cards. However, there are credit card options available that can help you build your credit score and get on the path to better financial standing.

Secured credit cards

If you have a 600 credit score and are looking to build or rebuild your credit, secured credit cards can be a great option. These cards require a security deposit that serves as collateral in case you default on your payments. The amount of your credit limit is typically equal to the deposit you make.

Here are some of the best secured credit cards for a 600 credit score:

| Card Name | Annual Fee | Minimum Deposit | Key Benefits |

|---|---|---|---|

| Citi® Secured Mastercard® | $0 | $200 | Earns rewards on eligible purchases |

| Discover It® Secured Credit Card | $0 | $200 | Offers cash back rewards |

| Capital One® Secured Mastercard® | $0 | $49, $99, or $200, depending on your creditworthiness. | the credit limit with responsible use. |

Starter credit cards

If you’re new to credit or have limited credit history, starter credit cards can be a good fit for a 600 credit score. These cards are designed for individuals with lower credit scores or little credit history, allowing you to establish credit and work towards improving your credit score.

Here are some of the best starter credit cards for a 600 credit score:

- Petal® 2 “Cash Back, No Fees” Visa® Credit Card: No annual fee and offers cash back rewards on eligible purchases.

- Credit One Bank® Platinum Visa® can help build credit with responsible use and offers a variety of benefits.

- OpenSky® Secured Visa® Credit Card: No credit check required and reports to the three major credit bureaus.

Remember, when using any credit card, it’s important to make your payments on time and keep your credit utilization low to help improve your credit score over time. With responsible use of these credit cards, you can start rebuilding your credit and pave the way for better financial opportunities.

Tips for Responsible Credit Card Use

When it comes to using credit cards with a 600 credit score, responsible use is key. With a mediocre credit score, it’s important to adopt smart financial habits to improve your creditworthiness over time. Here are a few tips to help you make the most of your credit cards:

Managing credit utilization

One of the most crucial elements influencing your credit score is your credit utilization ratio. This ratio is the amount of credit you currently have outstanding compared to your total available credit. To improve your credit score, it’s recommended to keep your credit utilization below 30%. Here’s how you can manage your credit utilization:

- Keep an eye on your credit card balances and aim to pay them off in full each month.

- If you can’t pay off your bills completely, attempt to keep them as low as possible.

- Avoid maxing out your credit cards, as this might hurt your credit score.

- Consider requesting a credit limit increase, which can help lower your credit utilization ratio.

Timely Payments

Making timely payments is vital for keeping a decent credit score. Late payments can significantly harm your creditworthiness, so it’s important to stay on top of your credit card due dates. Follow these tips to ensure you make payments on time:

- Set up automatic payments to avoid forgetting to make payments.

- Consider setting payment reminders on your phone or calendar.

- If you’re unable to make the full payment, always strive to make the minimum payment on time.

- If possible, pay more than the minimum payment to reduce the amount of interest you’ll accrue.

Regularly Monitoring Your Credit Report

Monitoring your credit report is essential to staying informed about your creditworthiness and identifying any potential errors or fraudulent activities. Here’s how you can stay on top of your credit report:

- Request a free copy of your credit report each year from each of the three main credit agencies.

- Review your credit report thoroughly, checking for any inaccuracies or discrepancies.

- If you spot any errors, report them promptly to the credit bureaus to have them corrected.

- Consider signing up for credit monitoring services to receive regular updates on your credit activity.

By managing your credit utilization, making timely payments, and regularly monitoring your credit report, you can start to build a stronger credit profile even with a 600 credit score. Remember, responsible credit card use is essential for improving your financial health and increasing your creditworthiness over time.

Frequently Asked Questions About Credit Cards for a 600 Credit Score

Can I Get a Credit Card with a Credit Score of 600?

Yes, you can still get a credit card with a 600 credit score. However, your options may be limited and you may need to opt for secured credit cards or cards with higher interest rates. It’s important to compare different options and choose a card that aligns with your financial goals.

How Can I Improve My Credit Score To Qualify For Better Credit Cards?

To improve your credit score, start by paying your bills on time, reducing credit card balances, and avoiding opening new accounts unnecessarily. Regularly reviewing your credit report for problems and challenging any inaccuracies can also help you improve your score. Building a positive payment history over time will increase your chances of qualifying for better credit cards.

What Fees Should I Be Aware Of Before Applying For A Credit Card?

Before applying for a credit card, be aware of fees such as annual fees, late payment fees, over-limit fees, and balance transfer fees. Read the terms and conditions carefully to fully understand the charges associated with the card. Compare fees among different credit cards and choose one that offers reasonable fee structures.

Conclusion

Securing a credit card with a 600 credit score is within reach. By understanding the available options and taking proactive steps to improve your creditworthiness, you can access suitable credit cards that meet your financial needs. With responsible use, you can effectively rebuild your credit and pave the way for a secure financial future.