The intersection of credit score and mortgage rates to secure the best possible terms for your home loan. Uncover the strategies to elevate your creditworthiness and position yourself for a successful homeownership journey.

When applying for a mortgage, your credit score plays a crucial role in determining the interest rate you’ll be offered. Mortgage providers assess your credit score to gauge the risk associated with lending you money, which in turn affects the interest rate you’ll receive.

Generally, a higher credit score corresponds to lower interest rates, while a lower credit score means you may be offered higher interest rates. Therefore, it’s essential to understand how your credit score influences mortgage rates and to take steps to improve your score before applying for a mortgage. By being aware of this connection and actively working to improve your credit score, you can potentially secure better mortgage rates and save significant amounts of money over the life of your loan.

Credit: www.forbes.com

How Credit Score Affects Mortgage Rates

Your credit score can have a significant impact on the mortgage rates you are offered. A higher credit score generally translates to lower interest rates, while a lower credit score can result in higher rates. It’s important to maintain a good credit score to secure a favorable mortgage rate.

Understanding The Relationship

The impact of credit score on mortgage rates cannot be emphasized enough. Your credit score plays a crucial role in determining the interest rate you will be offered on your mortgage. Lenders use your credit score as an indicator of your financial responsibility and the level of risk they are willing to take by lending you money. The better your credit score, the lower your mortgage rate will be, potentially saving you thousands of dollars over the life of your loan.

Factors That Influence Mortgage Rates

Several factors come into play when determining mortgage rates. However, your credit score holds significant weight in this decision-making process. Here are some factors that influence mortgage rates:

- Credit Score: A higher credit score signifies a lower risk borrower, resulting in more favorable mortgage rates.

- Loan-To-Value Ratio: The ratio of your loan amount to the value of your home. A lower ratio indicates less risk for the lender and can lead to better interest rates.

- Debt-To-Income Ratio: This ratio measures your monthly debt payments compared to your gross monthly income. A lower ratio shows higher financial stability and can result in lower mortgage rates.

- Credit History: A longer and positive credit history demonstrates responsible borrowing behavior and can contribute to more competitive mortgage rates.

- Loan Type: Different loan types, such as FHA insured loans, conforming loans, fixed-rate mortgages, jumbo mortgages, and adjustable-rate mortgages, have different interest rate structures. Your credit score can impact the rates offered for each loan type.

By understanding these factors, you can see how crucial it is to maintain a good credit score. Even a slight improvement in your credit score can have a significant impact on the interest rate you receive when applying for a mortgage. So, it is essential to monitor and improve your credit score before starting the mortgage approval process.

Credit: www.michaeladeery.com

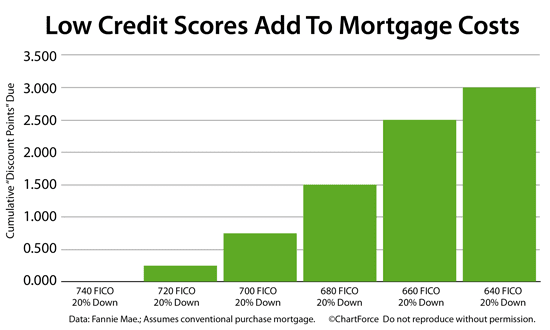

Mortgage Rates Based On Credit Score

When it comes to securing a mortgage, your credit score plays a critical role in determining the interest rate you’ll receive. Applicants with higher credit scores typically secure lower mortgage rates, ultimately leading to cost savings over the life of the loan. Understanding the correlation between credit score and mortgage rates can help prospective homeowners make informed decisions when navigating the home buying process.

Average Rates By Credit Score Range

Below is an overview of average mortgage rates based on credit score brackets, reflecting the potential impact on borrowing costs:

| Credit Score Range | Average APR | Estimated Monthly Payment |

|---|---|---|

| 760-850 | 6.38% | $1,873 |

| 700-759 | 6.602% | $1,916 |

| 680-699 | 6.779% | $1,952 |

| 660-679 | 6.993% | $1,994 |

Impact On Monthly Payments

Your credit score directly impacts the interest rate you’ll receive on a mortgage, which subsequently affects your monthly mortgage payments. A higher credit score typically results in a lower interest rate, translating to reduced monthly payments. For example, a borrower with a credit score in the 760-850 range could potentially save hundreds of dollars each month compared to someone with a credit score in the 660-679 range.

Yearly Fluctuations In Mortgage Rates

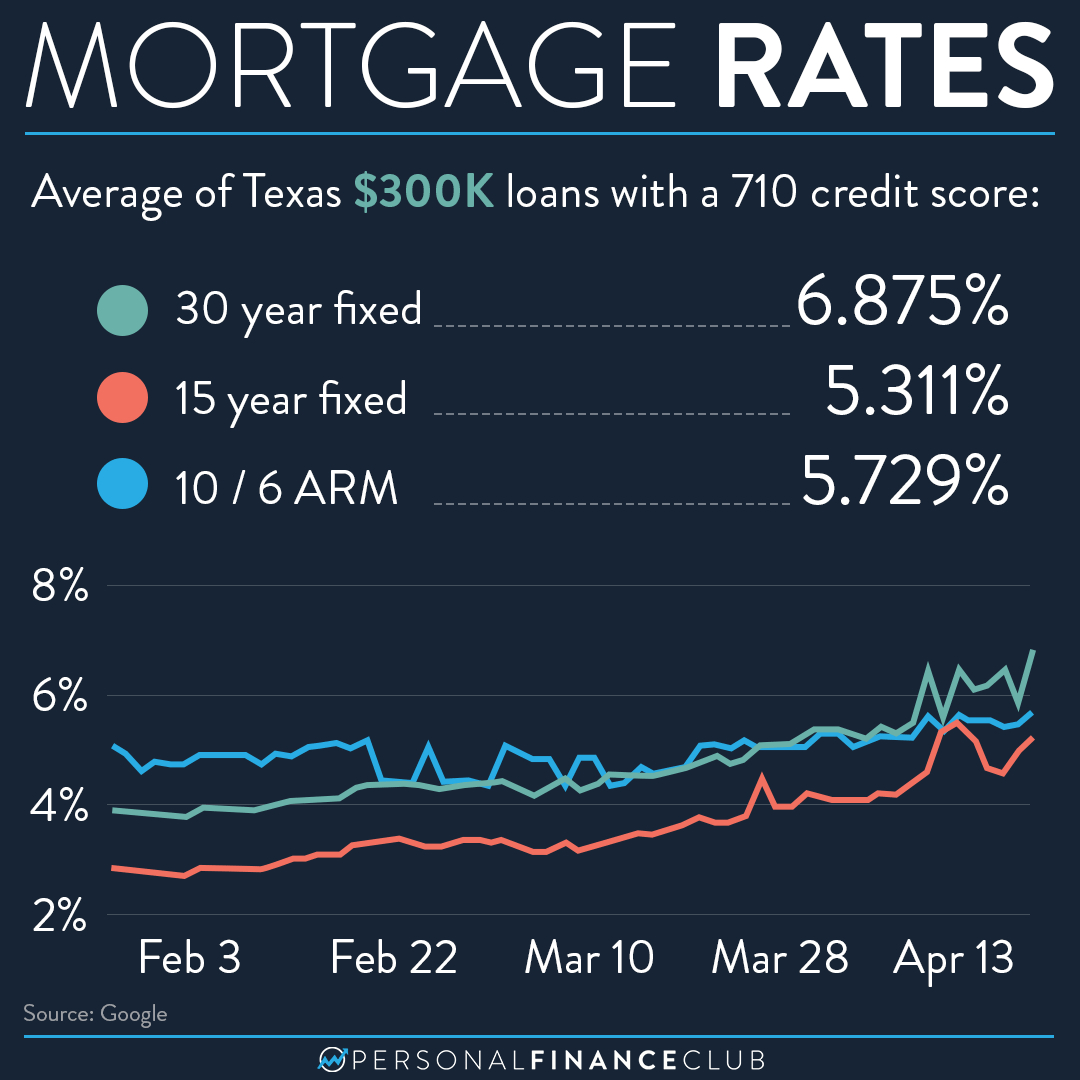

Yearly fluctuations in mortgage rates have a significant impact on the financial landscape for potential homebuyers. Understanding these patterns and how they can be influenced by credit scores is essential for anyone considering taking out a mortgage. Let’s explore the factors that contribute to these fluctuations and the role that credit scores play in determining mortgage rates.

Overview Of Mortgage Rate Trends

Over the years, mortgage rates have exhibited fluctuations that can greatly influence the cost of homeownership. These fluctuations are influenced by various factors, such as economic conditions, inflation rates, and the overall performance of the housing market. By analyzing historical data, it becomes evident that mortgage rates are subject to both short-term and long-term fluctuations. Understanding these trends is crucial for prospective homeowners as they navigate the process of securing a mortgage.

The Role Of Credit Score In Rate Fluctuations

A borrower’s credit score is a key determinant in the fluctuation of mortgage rates. Lenders use credit scores to assess the risk associated with lending money to a particular borrower. A higher credit score typically indicates a responsible financial history, leading to lower perceived risk for lenders and, consequently, lower mortgage rates. On the other hand, lower credit scores may result in higher perceived risk and higher mortgage rates. This underscores the importance of maintaining a good credit score when seeking favorable mortgage rates. Consequently, prospective homebuyers should prioritize improving their credit scores to secure the most favorable mortgage rates possible.

Credit: www.personalfinanceclub.com

Mortgage Rates For Different Loan Types

When it comes to securing a mortgage, it’s essential to understand that not all mortgage rates are the same. Different loan types have varying interest rates, which can greatly impact the overall cost of borrowing. Whether you’re considering an FHA insured loan, a conforming loan, a fixed-rate mortgage, a jumbo mortgage, an adjustable-rate mortgage, or an interest-only loan, it’s crucial to know how each type can affect your mortgage rate and potentially your ability to afford a home.

Fha Insured Loan Rates

An FHA insured loan, backed by the Federal Housing Administration, is a popular option for first-time homebuyers and individuals with less-than-perfect credit. These loans typically offer competitive interest rates compared to conventional loans. However, make sure to check with different lenders, as rates can vary.

Credit Score And Mortgage Rates Conforming Loan Rates

A conforming loan follows the guidelines set by Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy mortgages from lenders. Conforming loan rates tend to be more favorable than jumbo loan rates, as they pose lower risks to lenders. Keep in mind that conforming loan rates may differ based on your credit score and other factors.

Fixed-rate Mortgage Rates

A fixed-rate mortgage offers stability and predictability since the interest rate remains the same over the life of the loan. This type of loan is ideal for borrowers who prefer consistent monthly payments and want to lock in a low interest rate. Fixed-rate mortgages typically have slightly higher rates compared to adjustable-rate mortgages but provide peace of mind.

Jumbo Mortgage Rates

A jumbo mortgage is a loan that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac. These loans are typically used for higher-priced properties. Jumbo mortgage rates can be higher than conforming loan rates due to the increased risk associated with larger loan amounts. It’s essential to shop around and compare rates from different lenders to ensure you find the best deal.

Adjustable-rate Mortgage Rates

An adjustable-rate mortgage (ARM) offers an initial fixed interest rate for a specific period, typically 5, 7, or 10 years, before transitioning to an adjustable rate. ARM rates can vary based on market conditions and are usually lower in the beginning compared to fixed-rate mortgages. If you plan to stay in a home for a shorter period or expect interest rates to decrease, an ARM can be a suitable option.

Interest-only Loan Rates

An interest-only loan allows borrowers to pay only the interest portion of the loan for a specified period, often 5 or 10 years, before the loan converts into a conventional mortgage. Interest-only loan rates can be higher than traditional mortgage rates, as they may carry more risk for lenders. It’s important to understand the terms of an interest-only loan and consider how it aligns with your long-term financial goals.

Pros And Cons Of A Higher Credit Score

A higher credit score can have several pros and cons when it comes to mortgage rates. On the positive side, a higher credit score can lead to lower interest rates and better loan terms. However, it’s important to note that a higher credit score may also require a larger down payment and stricter qualification requirements.

Lower Interest Rates And Monthly Payments

A higher credit score can have a significant impact on the interest rates and monthly payments you receive on your mortgage. Lenders use credit scores as a measure of your creditworthiness, with higher scores indicating a lower risk of defaulting on the loan. With a higher credit score, you are seen as less risky to lenders, and they are more likely to offer you lower interest rates.

Lower interest rates directly translate into lower monthly payments. Let’s take a look at an example to understand the potential savings. Suppose you are looking to borrow $200,000 for a 30-year fixed-rate mortgage. With a credit score of 620, you may be offered an interest rate of 4.5%. This would result in a monthly payment of approximately $1,013. However, if your credit score is 760 or above, you might qualify for an interest rate of 3.5%, reducing your monthly payment to around $898.

As you can see, even a one percentage point difference in interest rates can save you hundreds of dollars every month. Throughout a 30-year loan, these savings can add up to tens of thousands of dollars.

Easier Loan Approval And Better Loan Terms

Having a higher credit score not only improves your chances of getting approved for a mortgage but also opens doors to better loan terms. Lenders often have minimum credit score requirements for loan approval, and a higher score puts you in a better position to meet those requirements.

With a higher credit score, you are more likely to qualify for loan programs with more favorable terms, such as lower down payment requirements, lower closing costs, and the option to waive private mortgage insurance (PMI). These perks can save you thousands of dollars upfront and over the life of your loan.

Furthermore, a higher credit score can give you more negotiating power with lenders. They may be willing to offer you additional incentives, such as interest rate discounts or flexible repayment options.

| Pros | Cons |

|---|---|

| Easier loan approval | Harder to improve your score lower |

| r interest rates may | y require more stringent financial discipline |

| Lower monthly payments may | May limit your borrowing options better |

| r loan terms |

In conclusion, a higher credit score can have numerous advantages when it comes to securing a mortgage. It can help you obtain lower interest rates, resulting in lower monthly payments. Additionally, a higher credit score increases your chances of getting approved for a loan and allows you to access better loan terms. However, it’s important to note that improving your credit score takes time and effort and may require stricter financial discipline. Overall, maintaining a good credit score provides significant benefits when it comes to obtaining a mortgage and saving money in the long run.

Frequently Asked Questions On Credit Score And Mortgage Rates

Does Your Credit Score Affect Your Mortgage Interest Rate?

Yes, your credit score affects your mortgage interest rate. A higher score generally results in lower rates.

What Credit Score Gets A Good Mortgage Rate?

A credit score of 760 to 850 gets the best mortgage rates. This is because lenders offer lower rates for higher credit scores.

What Mortgage Rate Can I Get With A 780 Credit Score?

With a 780 credit score, you can expect to get a good mortgage rate.

What Interest Rate Can I Get With A 750 Credit Score?

With a 750 credit score, you may qualify for a good mortgage rate. However, the exact interest rate will depend on various factors such as the lender, loan type, and current market conditions.

Conclusion

Your credit score plays a crucial role in determining the mortgage rate you will get. Lenders consider your credit score as an indicator of your creditworthiness and utilize it to assess the risk of lending to you. A good credit score can lead to lower interest rates, while a lower score can result in higher rates.

It’s important to maintain a good credit score by paying bills on time and managing your debts responsibly. By understanding how your credit score impacts your mortgage rate, you can take steps to improve your score and secure a better rate.