When it comes to managing finances, it’s crucial to understand how various factors can impact your credit score. One question that often arises is whether student loans affect credit scores. Student loans can indeed affect your credit score, but the extent to which it does depends on your payment history.

Missing a single payment may not have a significant impact, but if you consistently miss payments or fall behind on your student loan payments, it can negatively affect your credit score. We will explore how student loans affect credit scores and provide some insights on how to manage your student loan payments to maintain a good credit score.

Credit: www.experian.com

The Impact Of Student Loans On Credit Score

When it comes to credit scores, student loans can have a significant impact. Late or missed payments can lower your score, affecting your ability to qualify for a mortgage or other loans. With payment history accounting for over one-third of your score, it’s important to stay on top of your student loan payments.

Understanding Payment History

One of the key factors that lenders consider when evaluating your creditworthiness is your payment history. This includes your ability to make timely payments on all of your debts, including student loans. Any missed or late payments can negatively impact your credit score. In fact, even a single missed payment can lower your credit score, and late payments can stay on your credit report for up to seven years.

It’s important to note that different types of loans may have different consequences on your credit score. Federal student loans typically offer more flexible repayment options, such as income-driven repayment plans, which can help borrowers avoid default and mitigate the negative impact on their credit score. However, private student loans may have stricter repayment terms, and missed payments can have a more significant impact on your credit score.

Impact On Credit Utilization

Another factor that plays a role in determining your credit score is your credit utilization. This refers to the amount of your available credit that you are currently using. Your credit utilization ratio is calculated by dividing your total credit card balances by your total credit limits. It’s recommended to keep your credit utilization below 30% for optimal credit health.

When it comes to student loans, they are considered installment loans, which have a different impact on your credit utilization compared to revolving credit like credit cards. Student loan debt may impact your installment loan utilization, but it won’t directly affect your revolving credit utilization. However, it’s essential to maintain a manageable debt-to-income ratio, as lenders take this into account when determining your creditworthiness.

Length Of Credit History

Your credit history’s length also plays an important role in calculating your credit score. The longer you have a credit account, the better it is for your credit score because it demonstrates your ability to manage credit responsibly over time. This includes your student loan account as well.

Having a student loan can contribute positively to your credit history length, especially if you make consistent, on-time payments. However, it’s crucial to remember that closing your student loan account after paying it off may actually shorten your credit history. So, keeping the account open (even with a zero balance) can help maintain a longer credit history and positively impact your credit score.

Effects On Mortgage And Home Buying

Student loans can have a significant impact on your credit score and financial situation, affecting your ability to qualify for a mortgage and buy a home. In this section, we will discuss how student loans influence your mortgage qualification and impact your ability to buy a home.

Influence On Mortgage Qualification

When considering your mortgage application, lenders take various factors into account, including your credit score and debt-to-income ratio. Student loans, being a form of debt, can affect your ability to qualify for a mortgage. If you have a high student loan balance, it may increase your debt-to-income ratio, making it more challenging to meet the lender’s eligibility criteria.

Lenders often prefer borrowers with lower debt-to-income ratios, as it indicates a higher likelihood of repaying the mortgage on time. If your student loan payments consume a significant portion of your monthly income, it may negatively impact your qualification for a mortgage, as lenders may consider you to be a higher risk borrower.

Impact On Ability To Buy A Home

Apart from affecting your mortgage qualification, student loans can also impact your overall ability to buy a home. The amount of student loan debt you carry can affect your credit score, which plays a crucial role in the home-buying process. A lower credit score may result in higher interest rates or even rejection of your mortgage application by lenders.

Additionally, student loan payments can restrict your financial flexibility, making it challenging to save for a down payment or afford monthly mortgage payments. The more of your income that goes towards student loan payments, the less you have available for other financial goals, such as saving for a home.

Consequences Of Defaulting On Student Loans

Defaulting on student loans can have serious repercussions, impacting not only your financial situation but also your credit score. Understanding the potential consequences of defaulting is crucial to making informed choices and managing your student debt responsibly.

Credit Score Implications

Defaulting on student loans can have a detrimental impact on your credit score. Missing payments or entering default status can significantly lower your credit score, making it more challenging to secure future loans, such as mortgages or car loans. The negative effects on your credit score can last for several years, hindering your financial prospects and increasing the cost of borrowing.

Repercussions Of Missed Payments

Missed or late payments on student loans can result in penalties, fees, and increased interest rates, further exacerbating your financial burden. Persistent missed payments may lead to your loans being sent to collections, causing additional stress and potential legal action. It is essential to address missed payments promptly and explore options like income-driven repayment plans or loan deferment to avoid defaulting and protect your credit score.

Student Loans And Credit Reports

When it comes to managing your finances as a student, understanding how student loans can impact your credit score is essential. Student loans play a significant role in your credit reports, affecting factors such as payment history and the amount owed. In this section, we will delve deeper into the relationship between student loans and credit reports, exploring how they impact your credit score.

Inclusion In Credit Reports

Your credit reports, which directly influence your credit score, contain valuable information about your student loans. When you take out a student loan, it becomes a crucial part of your credit report. This inclusion allows lenders and creditors to assess your financial responsibility and ability to manage debt effectively.

In addition to basic information about your loans, such as the loan type and servicer, your credit reports also provide details about the amount that you owe on your loans and your payment history. These components offer insights into your overall creditworthiness and the likelihood of fulfilling your financial obligations.

Amount And Payment History Impact

The amount you owe on your student loans and your payment history significantly influence your credit score. Your payment history, which accounts for over one-third of your credit score, reflects your track record of making regular and timely payments.

If you consistently make payments on time, it demonstrates financial responsibility, positively impacting your credit score. However, missing payments or making late payments can have detrimental effects on your credit score. A single missed payment can lower your score, and late payments can remain on your credit report for up to seven years.

Additionally, the total amount you owe on your student loans affects your credit utilization ratio. This ratio represents the percentage of available credit you are using compared to your total credit limit. A high credit utilization ratio, resulting from substantial student loan debt, can negatively impact your credit score.

To maintain a healthy credit score, it is crucial to manage your student loan payments diligently and avoid defaulting on your loans. Paying your loans on time and keeping your balances low can contribute to an improved credit score and open doors to future financial opportunities.

Other Factors Influencing Credit Score

When it comes to credit scores, student loans can have a significant impact. However, there are also other factors that influence your credit score. Understanding these factors can help you manage your finances better and improve your creditworthiness.

Refinancing Student Loans

If you’re struggling to make your student loan payments, refinancing can be an option to consider. Refinancing involves taking out a new loan to pay off your existing student loans. This new loan often comes with a lower interest rate or monthly payment, making it more manageable for you.

Besides making your payments more affordable, refinancing can also positively impact your credit score. When you refinance, your old loans are paid off in full, and a new loan is opened. This shows responsible financial behavior and can improve your credit score over time.

Co-signed Loans And Credit Scores

Another factor that affects your credit score is co-signed loans. When someone co-signs a loan with you, they are equally responsible for repaying the loan. This means that any missed payments or negative credit behavior can affect both your credit score and the co-signer’s credit score.

On the positive side, if you make your payments on time and manage the loan responsibly, it can have a positive impact on your credit score and the co-signer’s credit score. This can be beneficial if you’re trying to establish or improve your credit history.

Conclusion:

In conclusion, while student loans do have an impact on your credit score, there are other factors that influence your creditworthiness as well. Refinancing your student loans and managing co-signed loans responsibly can positively affect your credit score. By understanding these factors, you can take control of your finances and work towards improving your creditworthiness.

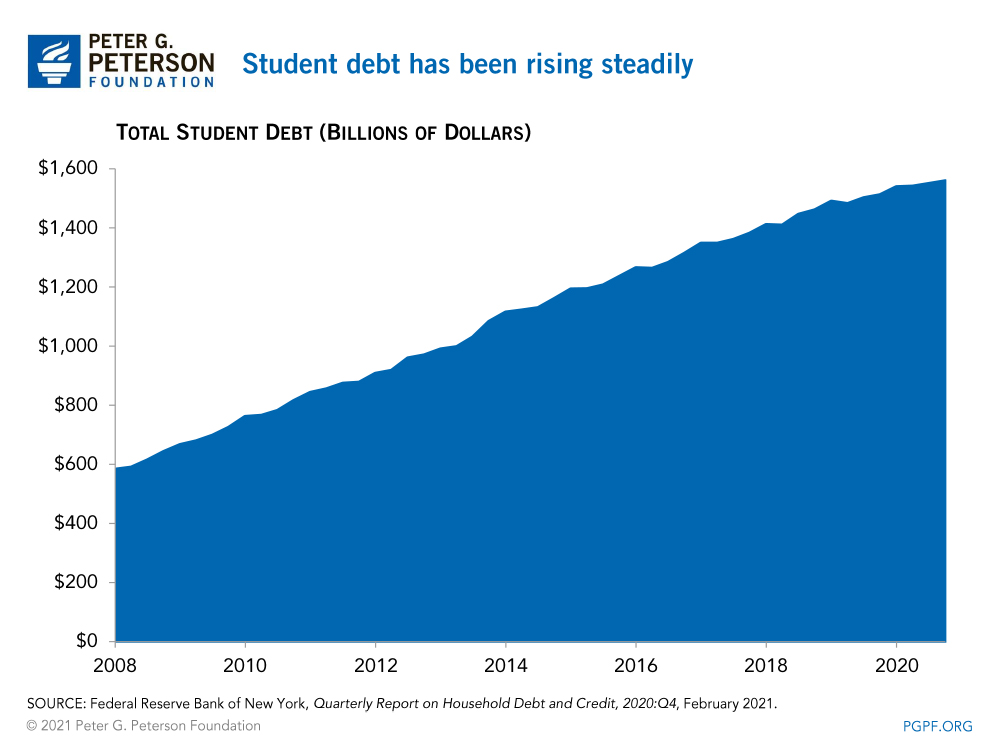

Credit: www.pgpf.org

FAQ On Do Student Loans Affect Credit Score

How Much Does Student Loans Affect Credit Score?

Late or missed payments on student loans can negatively impact your credit score. Even a single missed payment can lower your score, and late payments can remain on your credit report for up to seven years. It is important to stay on top of your payments, as your payment history makes up a significant portion of your credit score.

Does Student Loan Affect Buying A House?

Yes, student loans can affect buying a house as lenders consider your credit score, including existing debt like student loans, when determining your eligibility for a mortgage. It is important to maintain a good payment history on your loans to avoid negatively impacting your credit score.

Do Student Loans Go Away After 7 Years?

Student loans don’t automatically go away after 7 years. In many cases, they stay on your credit report and can still affect your financial standing. If you default on the loan, it can have long-term consequences on your credit.

Do Student Loans Count Towards Credit Utilization?

Student loans may impact your credit utilization ratio, especially for installment loans. However, revolving credit utilization, like credit card debt, is not affected by student loans. It is important to make timely payments to maintain a good credit score.

Conclusion

Student loans can have a significant impact on your credit score. Your payment history plays a crucial role in determining your creditworthiness, so it’s essential to make timely payments to avoid a negative effect on your credit score. It’s important to stay informed about how student loans can affect your credit score to better manage your financial future.