A credit score of 700 is generally considered good for a car loan. When it comes to applying for a car loan, having a good credit score is essential.

A credit score of 700 is generally considered good by many lenders, which increases your chances of getting approved for a car loan. This score indicates that you have a solid credit history and are likely to make repayments on time.

With a good credit score, you may also be eligible for lower interest rates on your car loan, resulting in lower monthly payments. Ultimately, having a credit score of 700 puts you in a favorable position when seeking a car loan.

Understanding Credit Scores

A credit score of 700 is generally considered good for securing a car loan. This score earns favorable interest rates and approval from most lenders, making it a suitable option for purchasing a vehicle. Understanding credit scores can help individuals attain advantageous loan terms and save money in the long run.

Importance Of Credit Scores

Credit scores play a crucial role in determining your eligibility for various financial products, including car loans. Lenders use these scores to assess the risk involved in lending you money and to determine the terms of the loan, such as interest rates. A good credit score indicates that you have managed your finances responsibly and are more likely to make timely payments.

Having a good credit score can provide several benefits when applying for a car loan. It can result in lower interest rates, saving you money in the long run. A higher credit score may also give you more negotiating power with lenders, allowing you to secure a better deal on your car loan.

Factors Affecting Credit Scores

Several factors contribute to calculating your credit score, with each having a different level of impact:

- Payment history: Timely payments on credit cards, loans, and bills are essential for maintaining a good credit score.

- Credit utilization: The amount of credit you are currently using compared to your total available credit can impact your score. Keeping your credit utilization ratio low is generally considered favorable.

- Length of credit history: The longer your credit history, the more information lenders have to assess your creditworthiness. Having a longer credit history can positively impact your credit score.

- Credit mix: Having a variety of credit accounts, such as credit cards, installment loans, and mortgages, can help demonstrate your ability to manage different types of credit.

- New credit: Opening several new credit accounts in a short period can negatively affect your credit score, as it may indicate financial instability.

It’s important to note that these factors carry different weights in determining your credit score. Understanding them can help you make informed financial decisions and improve your creditworthiness over time.

Now that we have covered the importance of credit scores and the factors influencing them, let’s explore whether a credit score of 700 is considered good when applying for a car loan.

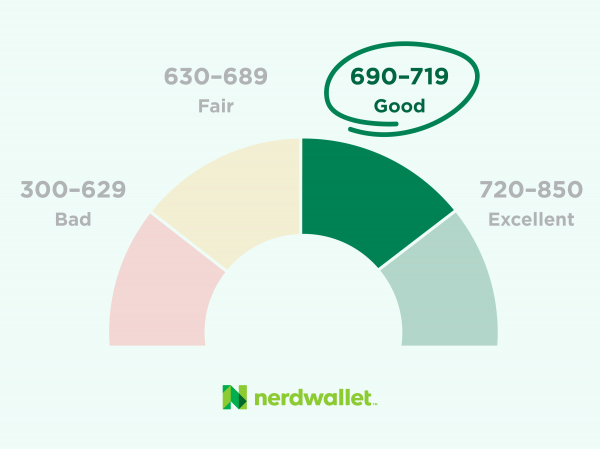

Credit: www.nerdwallet.com

Credit Score And Car Loans

A credit score plays a crucial role in determining your eligibility for a car loan. Lenders use your credit score as a measure of your creditworthiness, which affects the interest rates and terms they offer you. If you’re wondering what credit score is considered good for a car loan, then you’ve come to the right place. Let’s explore the impact of credit score on car loan eligibility and the average interest rates based on credit score.

Impact Of Credit Score On Car Loan Eligibility

Your credit score has a direct impact on your car loan eligibility. Lenders look at your credit score to assess the risk of lending you money. The higher your credit score, the more likely you are to qualify for a car loan with favorable terms and lower interest rates. On the other hand, a lower credit score may limit your options and lead to higher interest rates or even loan denial.

Here’s a breakdown of how credit scores typically affect car loan eligibility:

- Credit score of 720 and above: Considered excellent, and you’ll likely have no trouble getting approved for a car loan with the best interest rates.

- Credit score between 680 and 719: Considered good, and you should still be able to secure a car loan with favorable terms.

- Credit score between 620 and 679: Considered fair, and you may face some challenges in getting approved, as the interest rates may be higher.

- Credit score below 620: Considered poor, and it may be difficult to qualify for a car loan. Lenders may require a higher down payment or may even deny your loan application.

Therefore, it’s important to work on improving your credit score before trying to secure a car loan, as it can significantly impact your loan options and the overall cost of financing.

Average Interest Rates Based On Credit Score

Interest rates for car loans are primarily based on your credit score. A higher credit score usually translates to lower interest rates, resulting in significant savings over the life of the loan. The table below provides an overview of average interest rates based on various credit score ranges:

| Credit Score Range | Average Interest Rate |

|---|---|

| 781-850 | 3.17% |

| 661-780 | 4.03% |

| 601-660 | 6.79% |

| 501-600 | 11.41% |

| 300-500 | 14.41% |

As evident from the table, borrowers with excellent credit scores enjoy the lowest interest rates, while those with poor credit scores face significantly higher rates. Therefore, maintaining a good credit score not only improves your eligibility for a car loan but also helps you secure a more affordable financing option.

In conclusion, your credit score plays a vital role in determining your eligibility for a car loan and the interest rates you’ll be offered. A good credit score increases your chances of securing a car loan with favorable terms and lower interest rates. However, even if your score is not perfect, there are still options available. It’s crucial to shop around and compare offers from different lenders to find the best car loan option that suits your needs and budget.

Is 700 A Good Credit Score For A Car Loan

Is 700 a Good Credit Score for a Car Loan

Determination Of Good Credit Score For Car Loan Eligibility

When applying for a car loan, one of the most important factors that lenders consider is your credit score. A credit score of 700 is generally regarded as a good score for obtaining a car loan. However, it is important to note that different lenders may have different criteria for loan approval. It’s always a good idea to check with your specific lender to understand their requirements and determine if 700 is considered a good credit score in their eyes.

Advantages Of Having A 700 Credit Score For Car Loans

A credit score of 700 can provide several advantages when seeking a car loan. Let’s take a look at some of them:

- Favorable Interest Rates: Having a 700 credit score signifies good creditworthiness, which can help you secure a car loan with favorable interest rates. Lower interest rates can save you money in the long run, making your car loan more affordable.

- More Loan Options: With a credit score of 700, you are likely to have access to a wider range of loan options. Lenders may be more willing to offer you competitive loan terms and larger loan amounts, giving you more flexibility in choosing the perfect car.

- Increased Negotiating Power: A higher credit score gives you leverage during negotiations with car dealerships. With a 700 credit score, you are perceived as a lower-risk borrower, which can give you the confidence to negotiate better deals on the price of the car or other financing terms.

- Improved Loan Approval Chances: Having a 700 credit score significantly increases your chances of loan approval. Lenders are more likely to view you as a trustworthy borrower and are more willing to extend credit to you for your car purchase.

Having a credit score of 700 can open doors to more favorable loan terms and options when seeking a car loan. While 700 is considered a good credit score, it’s essential to maintain good credit habits to continue building your creditworthiness for future loan applications.

Improving Credit Score For Better Car Loan Options

Maintaining a credit score of 700 is considered good for securing favorable car loan options. A good credit score increases your chances of approval and can result in lower interest rates, ultimately saving you money in the long run. By improving your credit score, you can access better car loan options and potentially save on interest costs.

Strategies For Enhancing Credit Score

If you’re looking to improve your credit score for better car loan options, there are several strategies you can implement:

-

- Pay your bills on time:

One of the most significant factors influencing your credit score is your payment history. Consistently paying your bills on time demonstrates responsible financial behavior and can positively impact your credit score.

-

- Reduce your credit utilization:

Your credit utilization ratio is the percentage of available credit you’re currently using. Lowering this ratio by paying down balances can help improve your credit score. Aim to keep your credit utilization below 30%.

-

- Correct errors on your credit report:

Regularly review your credit report for any errors that may be negatively affecting your score. Dispute and get these errors corrected to ensure an accurate representation of your creditworthiness.

-

- Keep old credit accounts:

Length of credit history is another significant factor in determining your credit score. Keeping old credit accounts open, even if they are not in use, can positively impact your score by increasing your average account age.

-

- Limit new credit applications:

Applying for multiple new credit accounts within a short period can negatively impact your credit score. Each application generates a hard inquiry, which can temporarily lower your score. Be judicious in applying for new credit.

Benefits Of Higher Credit Score For Car Loan Options

Having a higher credit score can offer several benefits when it comes to securing a car loan:

-

- Lower interest rates:

Lenders often offer lower interest rates to individuals with higher credit scores. This can result in significant savings over the course of your loan.

-

- Favorable loan terms:

With a higher credit score, you are more likely to qualify for advantageous loan terms, such as longer repayment periods or lower monthly payments.

-

- Access to more financing options:

Having a good credit score expands your pool of potential lenders. This gives you more options to choose from, allowing you to find the loan that best suits your needs.

-

- Higher loan limits:

A higher credit score can increase the maximum loan amount you qualify for. This allows you to purchase a higher-priced vehicle or have more flexibility in your budget.

-

- Improved negotiating power:

When you have a strong credit score, you have more leverage during negotiations with lenders. This can give you the ability to negotiate better terms, such as a lower interest rate or reduced fees.

Credit: www.jdpower.com

FAQ For Is 700 A Good Credit Score For A Car Loan

What Kind Of Car Loan Rate Can I Get With A 700 Credit Score?

With a 700 credit score, you can expect to get a competitive car loan rate. Lenders generally consider this score as good, increasing your chances of qualifying for better rates. However, the specific rate you receive will depend on other factors such as your income, loan term, and the lender you choose.

Can I Get A 50k Car Loan With A 700 Credit Score?

Yes, it is possible to get a $50k car loan with a 700 credit score. Lenders consider a 700 credit score to be good and may offer you favorable loan terms. However, interest rates and approval will depend on other factors such as income, debt-to-income ratio, and the specific lender’s requirements.

How Rare Is A 700 Credit Score?

A 700 credit score is considered rare.

How Much Of A Loan Can I Get With A 700 Credit Score?

With a 700 credit score, you can potentially qualify for a loan. However, the amount you can get will vary depending on factors like your income and debt-to-income ratio. It’s best to consult with lenders to determine the specific loan amount you are eligible for.

Conclusion

A credit score of 700 is generally considered good for a car loan. This score puts you in the good credit category, making you eligible for competitive interest rates and loan terms. Lenders typically look for a credit score above 600 to qualify for a car loan.

However, it’s important to remember that a higher credit score can lead to better loan options and potentially lower interest rates. So if you’re aiming for a car loan, maintaining or improving your credit score can work in your favor.