Struggling with a low credit score? Low credit score loans can offer you the financial assistance you need, despite your credit history.

Accessing loans with a low credit score can be challenging, but they are available to help individuals facing financial difficulties. These specialized loans cater to individuals with low credit scores, providing access to essential funds when traditional lending avenues may not be an option.

While low credit score loans may come with higher interest rates, they provide an opportunity to rebuild credit and meet immediate financial needs. Understanding the options available for low credit score loans is essential for those seeking financial support. By exploring the possibilities, individuals can find suitable solutions to address their financial constraints and work towards a more stable financial future.

What Is A Low Credit Score Loan?

A low credit score loan is a financial option designed for individuals with less-than-perfect credit. It enables borrowers to access funds despite their credit history, helping them meet their financial needs and improve their credit scores over time.

Definition Of A Low Credit Score Loan

A low credit score loan, also known as a bad credit loan, is a financial tool designed to help individuals with poor credit histories access funds when they need it most. This type of loan is specifically tailored to individuals who have a low credit score, usually below a certain threshold set by the lender. Unlike traditional loans, low credit score loans are typically secured by collateral or may require a co-signer to mitigate the risk involved for the lender.

Reasons For Having A Low Credit Score

There are several factors that can contribute to having a low credit score. It’s important to understand these reasons to better comprehend the need for low credit score loans.

| Reasons for Low Credit Score |

|---|

| Late Payment History |

| High Credit Utilization |

| Foreclosure or Bankruptcy |

| Delinquent Accounts |

| Limited Credit History |

| Maxed Out Credit Cards |

| Identity Theft or Fraud |

One of the primary reasons why individuals have a low credit score is a history of late payments. Whether it’s missing payment deadlines or consistently paying bills after the due date, this can significantly impact one’s creditworthiness. Additionally, a high credit utilization ratio, which refers to the percentage of available credit being used, can negatively affect a credit score. Another common cause of a low credit score is foreclosure or bankruptcy, which can have a long-lasting impact on creditworthiness.

Delinquent accounts, where an individual fails to repay outstanding debts, contribute to a low credit score. Limited credit history, often faced by young adults or those who haven’t actively used credit in the past, can result in a low credit score as well. Maxing out credit cards and consistently carrying high balances can also lead to a low credit score. Lastly, instances of identity theft or fraud that result in unauthorized charges or unpaid debts can significantly impact credit scores.

Types Of Low Credit Score Loans

Low credit score can make obtaining a loan difficult, but there are options available for individuals in this situation. Understanding the types of low credit score loans can help you make a well-informed decision. Let’s explore the different options for low credit score loans:

Secured Loans

Secured loans are backed by collateral, such as a car or property, which reduces the risk for the lender. This allows individuals with low credit scores to borrow money at more favorable terms. However, it’s crucial to remember that if the borrower fails to repay, the lender can seize the collateral.

Unsecured Loans

Unsecured loans, on the other hand, do not require collateral. They are based solely on the borrower’s creditworthiness. While these loans may come with higher interest rates, they provide an option for individuals without assets to pledge as security.

Payday Loans

Payday loans are short-term, high-interest loans typically used by individuals with low credit scores. These loans are often considered risky due to their high fees and annual percentage rates. Borrowers need to repay the loan with their next paycheck, making it essential to consider the long-term financial implications before opting for a payday loan.

Benefits Of Low Credit Score Loans

Accessible Financing Option

Low credit score loans provide an accessible financing option for individuals who have struggled to obtain traditional loans due to poor credit history. These loans are designed to offer the necessary financial support to those who have been turned down elsewhere.

Opportunity To Improve Credit

By obtaining a low credit score loan and responsibly managing the repayment, borrowers have an opportunity to improve credit. Making timely payments on these loans can positively impact credit scores, allowing individuals to rebuild their creditworthiness over time.

Flexible Repayment Terms

Low credit score loans often come with flexible repayment terms, providing borrowers with the ability to tailor the loan terms to their financial situations. This flexibility can help ease the burden of repayment and make the loan more manageable.

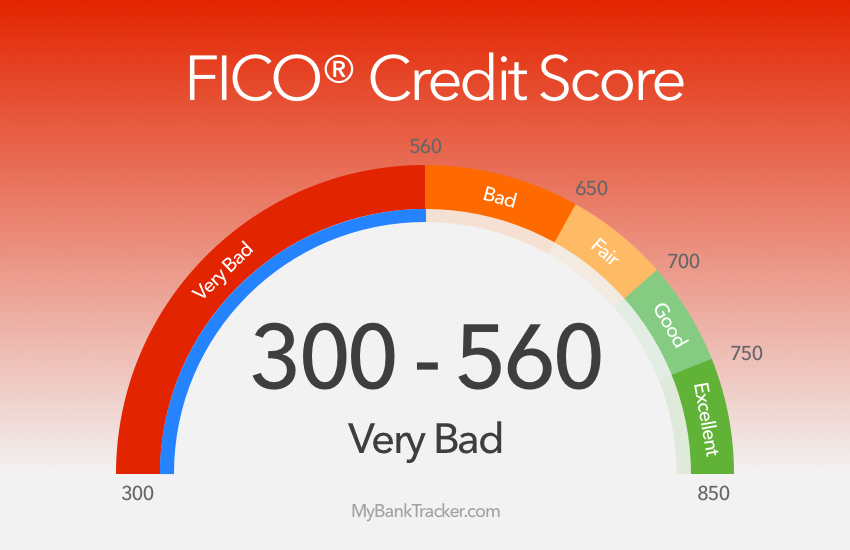

Credit: www.mybanktracker.com

Factors To Consider When Applying For A Low Credit Score Loan

When you have a low credit score, securing a loan can be challenging. However, it is not impossible. There are lenders who offer loans specifically designed for individuals with low credit scores. Before applying for such a loan, it is important to consider certain factors that can significantly impact your overall borrowing experience. By paying attention to these factors, you can ensure that you choose the right low credit score loan that suits your needs. In this article, we will discuss the key factors to consider when applying for a low credit score loan.

Interest Rates And Fees

One of the most important factors to consider when applying for a low credit score loan is the interest rates and fees associated with it. Since lenders consider individuals with low credit scores as higher risk borrowers, they might charge higher interest rates compared to traditional loans. It’s essential to carefully review and compare the interest rates offered by multiple lenders to ensure you are getting the most competitive rate. Additionally, keep an eye out for any hidden fees or charges that may be associated with the loan.

Here is a table summarizing important aspects related to interest rates and fees:

| Factors to Consider | Solution |

|---|---|

| Compare interest rates from different lenders | |

| Watch out for hidden fees or charges |

Loan Terms And Conditions

The loan terms and conditions play a critical role in determining the overall affordability of the loan. When applying for a low credit score loan, carefully review the terms and conditions set by the lender. Pay attention to the repayment period, monthly installment amounts, and any penalties for missed or late payments. It is crucial to choose a loan with terms that are realistic and manageable for your financial situation. Consider creating a budget to determine whether you can comfortably meet the repayment obligations before committing to the loan.

Lender’s Reputation And Credibility

When it comes to borrowing money, it is essential to choose a reputable lender with credibility. Research the lenders you are considering and look for reviews and feedback from past borrowers. A lender with a good reputation and positive reviews is more likely to provide a transparent and fair borrowing experience. Avoid lenders with a history of predatory practices or negative customer experiences. Remember, a reputable lender will have clear terms, transparent communication, and a commitment to helping borrowers improve their credit scores.

Tips For Obtaining A Low Credit Score Loan

Obtaining a low credit score loan is possible by following these tips: improve your credit score, provide collateral, search for lenders who specialize in low credit score loans, consider a co-signer, compare loan options, and be prepared for higher interest rates.

Introductory Paragraph: Tips For Obtaining A Low Credit Score Loan

If you have a low credit score, securing a loan can often feel like an uphill battle. However, with the right approach and preparation, it is still possible to find lenders who are willing to offer low credit score loans. In this article, we will discuss some essential tips that can help you improve your chances of obtaining a loan despite a less-than-perfect credit history. By following these tips, you can be well on your way to securing the necessary funds for your financial needs.

Review Your Credit Report

One of the first steps you should take before applying for a low credit score loan is to review your credit report. Your credit report provides valuable insights into your financial history and helps you identify any errors or discrepancies that may be negatively impacting your score. Pull a copy of your credit report from reputable credit bureaus like Experian, Equifax, or TransUnion. Carefully analyze the report to ensure all information is accurate and up to date. If you spot any errors or outdated information, such as accounts that have been paid off or are not yours, dispute them immediately to improve your credit score.

Compare Lenders

When it comes to low credit score loans, not all lenders are created equal. It’s crucial to compare lenders and their offerings to find the best fit for your needs. Start by researching reputable lenders who specialize in providing loans to individuals with low credit scores. Look for lenders who offer competitive interest rates, flexible repayment terms, and favorable customer reviews. Online platforms make it easy to compare lenders side by side, giving you a sense of their terms, requirements, and customer satisfaction ratings. Choose a lender that aligns with your priorities and offers the best chance of approval.

Prepare Necessary Documents

Before submitting your loan application, it is essential to gather all the necessary documents to streamline the process. Different lenders may require varying forms of documentation to evaluate your loan application. Common documents include proof of identity (such as a valid ID or passport), proof of income (such as pay stubs, tax returns, or bank statements), proof of residence (such as utility bills or lease agreements), and any additional supporting documents the lender may request. By preparing these documents in advance, you can expedite the loan application process and increase your chances of approval.

In conclusion, obtaining a low credit score loan may require extra effort, but it is certainly possible. By reviewing your credit report, comparing lenders, and gathering the necessary documents, you can enhance your chances of securing the loan you need. Keep in mind that improving your credit score over time can also open up more opportunities for favorable loan terms. With determination and the right approach, you can overcome the challenges of a low credit score and achieve your financial goals.

:max_bytes(150000):strip_icc()/are-personal-loans-bad-your-credit-score.asp_FINAL-44664c5b7c6b4d73b8ddc4699d545722.png)

Credit: www.investopedia.com

Frequently Asked Questions Of Low Credit Score Loans

Can I Get A Loan With A Low Credit Score?

Yes, it is possible to get a loan with a low credit score. However, you may have limited options and may need to consider alternative lenders who specialize in bad credit loans or explore securing the loan with collateral.

What Is Considered A Low Credit Score?

A low credit score is typically considered to be below 600. Credit scores range from 300 to 850, and a lower score indicates a higher risk for lenders. However, keep in mind that different lenders may have different criteria for what they consider to be a low credit score.

How Can I Improve My Credit Score To Qualify For A Loan?

To improve your credit score, focus on paying your bills on time, reducing the amount of debt you owe, and maintaining a low credit card utilization ratio. Additionally, checking your credit report for errors and disputing any inaccuracies can also help boost your credit score over time.

Conclusion

Having a low credit score shouldn’t prevent you from accessing the financial assistance you need. Low credit score loans can provide a lifeline, offering a solution when traditional lenders turn you down. By understanding the options available and seeking reputable lenders, you can find a loan that meets your needs and helps improve your credit score over time.

Don’t let your credit score hold you back – explore the possibilities of low credit score loans today.