An excellent credit score is a high numerical value that reflects a person’s creditworthiness and ability to repay loans. It is a key factor in determining the interest rates and credit offers individuals may receive.

A good credit score is vital for accessing loans and credit cards with favorable terms and conditions. It represents a person’s creditworthiness and financial responsibility. A high credit score indicates a strong credit history and the ability to manage debts effectively.

Lenders and financial institutions use credit scores to assess risk when extending credit to individuals. An excellent credit score demonstrates a low risk of default, making it easier to secure loans, obtain better interest rates, and access other financial opportunities. Understanding what constitutes an excellent credit score can help individuals make informed financial decisions and maintain a healthy credit profile.

Credit: mint.intuit.com

What Is An Excellent Credit Score

An excellent credit score is a numerical representation of an individual’s creditworthiness, reflecting their ability to manage debt responsibly. It is a measure that indicates how likely someone is to repay their debts and fulfill their financial obligations. A good credit score is essential for financial stability, providing numerous benefits and opportunities for individuals.

Definition Of A Credit Score

A credit score is a three-digit number that is calculated based on various factors, including an individual’s payment history, amount of debt owed, length of credit history, types of credit used, and recent credit inquiries. It serves as a summary of an individual’s creditworthiness and is used by lenders, landlords, and other financial institutions to evaluate the likelihood of a person repaying their debts.

Importance Of Having A Good Credit Score

Holding a good credit score is crucial for individuals as it opens up a world of financial opportunities. It demonstrates responsible financial behavior and makes it easier to secure loans, credit cards, and favorable interest rates. A good credit score also enhances the chances of getting approved for rental agreements, utility services, and even employment opportunities.

Having a strong credit score not only grants access to credit, but it often comes with perks such as higher credit limits, lower interest rates, and better loan terms. This can result in substantial savings over time and provide greater financial flexibility.

Benefits Of Having An Excellent Credit Score

An excellent credit score offers even more advantages compared to just having a good credit score. It portrays a higher level of creditworthiness and financial trustworthiness, providing individuals with even greater opportunities and benefits. Some notable advantages of having an excellent credit score include:

- Lower interest rates: Borrowers with excellent credit scores generally qualify for the lowest interest rates available, saving them substantial amounts of money on loans, mortgages, and credit card balances.

- Higher credit limits: Lenders are more likely to extend higher credit limits to individuals with excellent credit scores, providing access to more credit when needed.

- Faster loan approvals: Having an excellent credit score expedites the loan approval process, as potential lenders have confidence in the individual’s ability to repay the debt.

- Improved insurance rates: Excellent credit scores can lead to lower insurance premiums, including those for auto, home, and even life insurance policies.

- Increased negotiating power: With an excellent credit score, individuals have increased leverage when negotiating terms and conditions for loans or credit agreements, allowing them to secure more favorable deals.

Overall, an excellent credit score is an essential asset that can significantly impact an individual’s financial well-being and open up a world of opportunities.

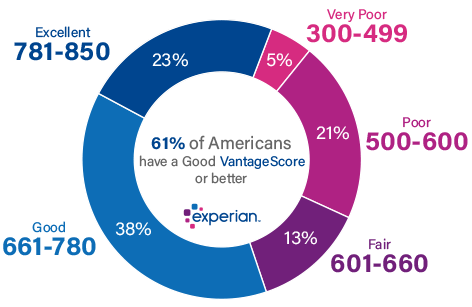

Credit: www.experian.com

Credit: money.com

What is Excellent Credit Score On What Is Excellent Credit Score

What Is An Excellent Credit Score?

An excellent credit score is typically considered to be a score above 800. It indicates a borrower’s low risk to lenders and makes it easier to get approved for loans and credit cards with favorable terms and interest rates.

How Can I Achieve An Excellent Credit Score?

To achieve an excellent credit score, you should make all your payments on time, keep your credit utilization ratio low, maintain a long credit history, and avoid opening too many new accounts. Regularly checking your credit report and disputing any errors can also help improve your score.

Why Is An Excellent Credit Score Important?

Having an excellent credit score is important because it demonstrates financial responsibility and makes it easier to qualify for loans, get lower interest rates, and secure better credit card offers. It also gives you negotiating power when it comes to borrowing money or applying for other financial products.

Can I Have An Excellent Credit Score Without A Credit Card?

While having a credit card can help you build credit and potentially achieve an excellent score faster, it is not the only way. You can also build credit by making on-time payments for other types of loans, such as a mortgage or car loan.

However, having a mix of credit types, including a credit card, often leads to a more well-rounded credit profile.

Conclusion

An excellent credit score is essential for financial stability and opportunities. It increases your chances of getting approved for loans, renting apartments, and even obtaining lower interest rates. By maintaining good credit habits – paying bills on time, keeping credit utilization low, and managing debts wisely – you can achieve and maintain an excellent credit score.

Remember, your credit score is a reflection of your financial responsibility, so prioritize building and maintaining it for a brighter future.