Your credit score may be going down due to factors such as paying off a loan, having your credit limit reduced, closing an account, or having a higher credit card balance than usual. These are all factors that can affect your score, as it is determined by specific formulas.

While it may feel like your score is dropping for no reason, there are often underlying factors at play. It’s important to closely monitor your financial activity to ensure you understand any changes in your credit score.

Understanding Credit Score Drops

If you’ve noticed a sudden drop in your credit score, you might be wondering what could have caused it. Understanding credit score drops can help you take the necessary steps to improve your score and maintain good financial health. In this section, we will explore the reasons for credit score drops, the impact of paying on time, and common misconceptions about credit score drops.

Reasons For Credit Score Drops

There are several factors that can contribute to a drop in your credit score. Here are some common reasons:

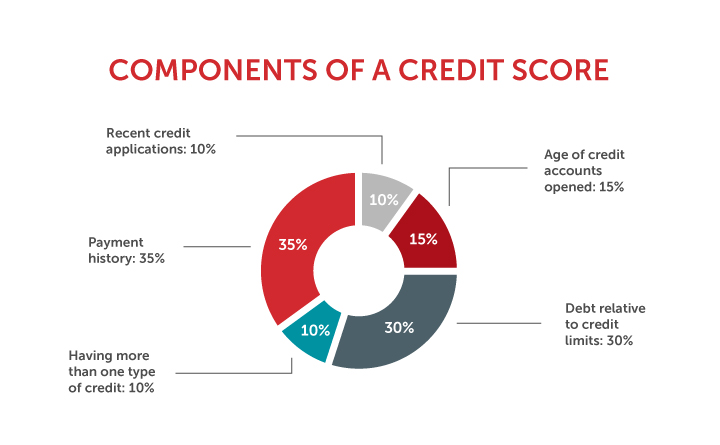

- Missed or late payments: Payment history is a significant factor in determining your credit score. Missing or making late payments can have a negative impact on your score.

- High credit utilization: The percentage of your available credit that you are using, also known as your credit utilization ratio, can affect your score. Keeping your credit utilization below 30% is generally recommended.

- Closing accounts: Closing credit accounts, especially older ones, can shorten your credit history and lower your score.

- New credit applications: Applying for new credit can result in a temporary decrease in your credit score. Multiple credit inquiries within a short period can be seen as a red flag and may lower your score.

Impact Of Paying On Time

While paying your bills on time is crucial, it’s essential to understand that it may not always positively impact your credit score immediately. Here are a few reasons why your score may drop even when you pay on time:

- Credit mix: Having a diverse mix of credit types, such as a combination of credit cards, loans, and mortgages, can positively impact your credit score. However, paying off a loan or closing an account might affect your credit mix and result in a temporary decrease in your score.

- Credit utilization ratio: Even if you pay your credit card balances on time, a high credit utilization ratio can still impact your score negatively. It’s crucial to keep your credit utilization ratio below 30%.

- Changes in credit limit: If your credit limit is reduced, it can increase your credit utilization ratio and potentially lower your credit score.

Misconceptions About Credit Score Drops

There are a few common misconceptions about credit score drops that need to be clarified:

- Credit scores don’t drop for no reason: While it may feel like your score has dropped for no apparent reason, there is always a specific factor or combination of factors causing the decrease.

- Paying off debt can lower your score temporarily: Paying off debt can impact factors such as credit mix, credit utilization ratio, and credit history length, which may result in a temporary decrease in your score. However, in the long run, reducing debt is beneficial for your financial health.

- Checking your credit score doesn’t affect it: Checking your credit score through reputable credit check platforms, like Credit Karma or FICO, does not impact your credit score. These are considered soft inquiries and do not have a negative effect.

Understanding the reasons behind credit score drops can help you make informed choices regarding your finances. If you are unsure about the drop in your credit score, it’s always a good idea to check your credit report for any errors or inconsistencies. By staying proactive and responsible with your credit, you can work towards improving and maintaining a healthy credit score.

Common Factors That Lower Credit Scores

There are several common factors that can lower credit scores, such as late or missed payments, changes to credit utilization rate, closing older accounts, or applying for new credit accounts. These actions can affect your credit mix, length of credit history, and credit utilization ratio, resulting in a lower score.

High Credit Card Balances

One common factor that can lower your credit score is having high credit card balances. When your credit card balances are consistently close to or at their credit limits, it can signal to lenders that you are relying heavily on credit and may be at risk of defaulting on your payments. This can negatively impact your credit utilization ratio, which is the amount of credit you are using compared to your total credit limit. To maintain a good credit score, it is recommended to keep your credit card balances below 30% of your credit limit.

Late Or Missed Payments

Another factor that can lower your credit score is making late or missed payments. Payment history is one of the most important factors that lenders consider when determining your creditworthiness. When you consistently make payments after the due date or skip payments altogether, it reflects negatively on your credit report. Lenders view this as a sign of financial irresponsibility and may be hesitant to extend credit to you in the future. To avoid this, be sure to always make your payments on time and in full.

Closing Credit Accounts

Closing credit accounts can also have a negative impact on your credit score. When you close a credit account, you are reducing your available credit and potentially increasing your credit utilization ratio. Additionally, closing an old credit account can shorten the length of your credit history, which can also lower your credit score. It is generally recommended to keep old credit accounts open, even if you don’t use them regularly, as they can contribute positively to your credit history and utilization ratio.

Effects Of New Credit Applications

One of the factors that can contribute to a drop in your credit score is the submission of new credit applications. When you apply for new credit, it can have several effects on your overall creditworthiness. Understanding these effects can help you make informed decisions about when to apply for new credit and how it may impact your credit score.

Credit Utilization Ratio

The first effect of new credit applications is the potential impact on your credit utilization ratio. Your credit utilization ratio is the percentage of your available credit that you are currently using. When you apply for new credit, it may increase your overall credit limit and result in a reduction in your credit utilization ratio. This can be viewed positively by lenders as it indicates that you are utilizing your credit responsibly and not maxing out your available credit.

Reduced Credit Limit

On the other hand, new credit applications can also lead to a reduced credit limit. Lenders may see multiple new credit applications as a potential risk and decide to lower your credit limit to mitigate that risk. A reduced credit limit can increase your credit utilization ratio and negatively impact your credit score. It’s important to be mindful of this potential outcome when applying for new credit and consider the impact it may have on your overall creditworthiness.

Paid Off Debt

An often overlooked effect of new credit applications is the impact on debt payment history. If you have recently paid off a significant amount of debt and then apply for new credit, it can actually lower your credit score. This is because paying off debt can affect factors such as your credit mix, length of credit history, and credit utilization ratio. Lenders may view this as a potential risk as it indicates a recent change in your financial situation, which can lead to a decrease in your credit score.

Credit: www.becu.org

Other Factors That Affect Credit Scores

Factors such as paying off a loan, having a credit limit reduction, or closing an account can cause a credit score to go down. Even having a higher credit card balance than usual can have an impact on your score. It may feel like your credit score dropped for no reason, but there are usually underlying factors at play.

While making timely payments is crucial for maintaining a good credit score, there are other factors that can impact it as well. Understanding these factors can help you navigate the complexities of credit scoring and take appropriate actions to protect your creditworthiness.

Increased Credit Utilization Ratio

A high credit utilization ratio—the amount of credit you have used compared to your total credit limit—can negatively affect your credit score. Lenders may view high credit utilization as an indication of financial instability, making you appear less creditworthy.

To keep your credit utilization ratio low, it’s important to manage your credit card balances responsibly. Paying off your balances in full each month and avoiding maxing out your credit cards can help maintain a healthy credit utilization ratio and improve your credit score.

Missed Payments

Consistently missing payments or making late payments can significantly impact your credit score. Payment history is a crucial factor in credit scoring, and lenders view missed payments as a sign of financial irresponsibility.

To avoid damaging your credit score, make it a priority to pay your bills on time. Set up automatic payments or reminders to ensure you never miss a due date. By demonstrating a pattern of timely payments, you can build a positive credit history and improve your credit score over time.

Closing Lines Of Credit

Closing lines of credit can also have an impact on your credit score. When you close a credit account, it can affect your credit utilization ratio and the length of your credit history, both of which are important factors in determining your creditworthiness.

While it may be tempting to close unused credit accounts, especially if they have annual fees, consider the potential impact on your credit score before making a decision. Instead, focus on keeping your credit accounts open and active, even if you don’t use them frequently. This can help maintain a diverse credit mix and contribute positively to your credit score.

Tips For Maintaining A Good Credit Score

Keeping a good credit score is crucial for financial stability and flexibility. Your credit score not only determines your eligibility for loans and credit cards but can also impact your ability to rent an apartment, get a job, or even negotiate better interest rates. If you’ve noticed your credit score going down recently, don’t panic. There are several steps you can take to maintain a good credit score and improve your financial health in the long run.

Monitor Credit Utilization

Your credit utilization ratio plays a significant role in determining your credit score. It refers to how much of your available credit you are currently using. A high credit utilization ratio can negatively impact your credit score. To maintain a good credit score, aim to keep your credit utilization below 30%. For example, if you have a total credit limit of $10,000, try to keep your outstanding balance below $3,000.

Pay Bills On Time

Payment history is one of the most critical factors affecting your credit score. Late payments can significantly harm your creditworthiness. To ensure that you never miss a payment, consider setting up automatic payments or reminders. Paying your bills on time not only helps maintain a good credit score but also shows lenders that you are responsible and trustworthy.

Keep Accounts Open

Contrary to popular belief, closing old accounts may not always be beneficial for your credit score. Length of credit history plays a role in determining your creditworthiness. Keeping your accounts open, especially those with a long credit history, can positively impact your credit score. However, this does not mean you should keep unused accounts open indefinitely. Take into consideration any annual fees or unnecessary expenses before deciding to close an account.

Credit: www.debt.org

Frequently Asked Questions On Why Is My Credit Score Going Down

Why Has My Credit Score Dropped For No Reason?

Your credit score may have dropped due to various factors like paying off a loan, credit limit reduction, closing an account, or having a higher credit card balance than usual. These actions can affect the formulas used to determine your score.

Why Did My Credit Score Go Down When I Pay Everything On Time?

Paying everything on time doesn’t guarantee an increase in your credit score. Factors like credit mix, credit history length, and credit utilization ratio can all affect your score. Paying off debt can actually lower your score if it impacts these factors.

Why Did My Credit Score Drop 100 Points?

Your credit score may have dropped for various reasons, such as paying off a loan or having your credit limit reduced. Closing an account or having a high credit card balance can also result in a lower score. Credit scores are determined by formulas, and any changes to your financial situation can impact your score.

Why Is My Credit Score So Much Lower?

Your credit score may be lower due to factors such as paying off a loan, reducing your credit limit, closing an account, or having a higher credit card balance than normal. Credit scores are determined by formulas, and these actions can impact your score.

Conclusion

It’s frustrating when your credit score drops unexpectedly. While it may feel like there’s no reason for the decline, there are several factors that can contribute to this. Paying off a loan, reducing your credit limit, closing an account, or having a higher-than-normal credit card balance can all result in a lower score.

It’s important to understand these factors and take steps to improve your credit. By managing your finances responsibly and staying informed about your credit, you can work towards maintaining a healthy credit score.